CSI 300 index fell by 4.4% in trading today

Meanwhile, the Shanghai Composite index also fell by 3.9% but despite the sharp drop in trading today, the weekly performance isn’t that bad for Chinese equities.

Meanwhile, the Shanghai Composite index also fell by 3.9% but despite the sharp drop in trading today, the weekly performance isn’t that bad for Chinese equities.

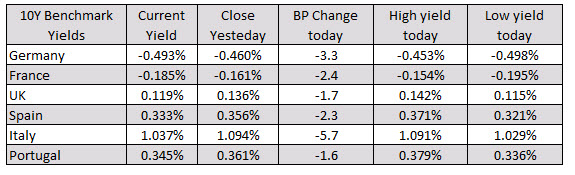

The major European indices are ending the day lower. The provisional closes are showing:

In other markets as London/European traders look to exit:

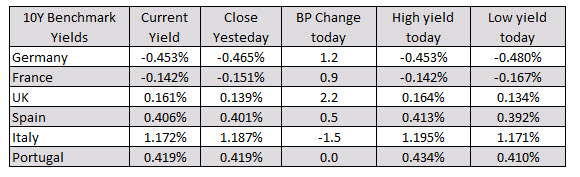

In other markets as London/European traders look to exit:The major European shares are ending the session higher. However, they are also closing near the lows for the day (and well of the highs for the day).

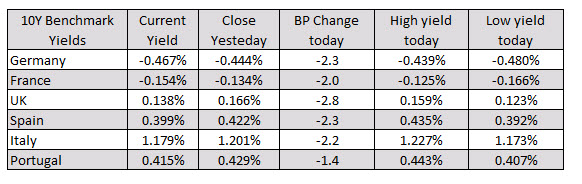

The European shares are ending the session with mixed results. France and Spain indices are lower. Germany, UK, Italy are trading higher.

The spike in coronavirus cases in Japan isn’t quite helping with sentiment among Japanese stocks but the overall mood today is a tough one to read anything from.

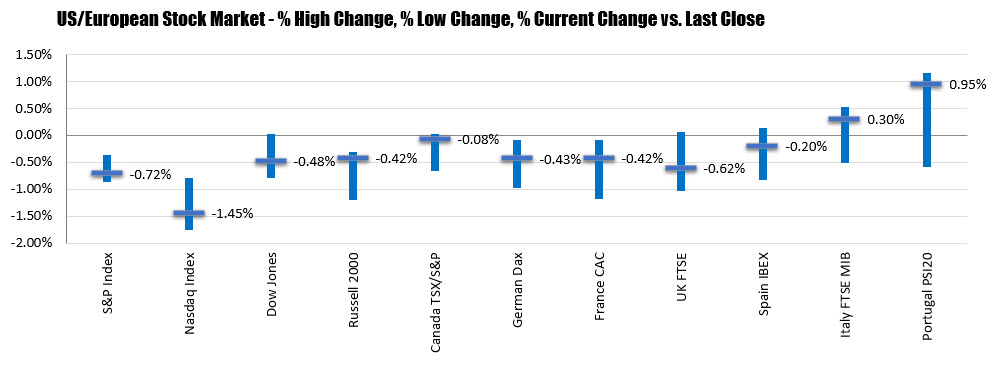

the major European indices are ending the session with mixed results. Germany, France, UK and Spain show declines while Italy and Portugal eked out gains. The closes are showing:

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit:

A poor day for Asian equities as profit-taking activity was the reason most alluded to for the drop after the Nikkei also touched a one-month high yesterday, not to mention the slump in Chinese equities as well.

The late surge by US stocks overnight is helping to give Asian equities a decent lift in trading today, though Chinese and Hong Kong stocks are weighed down by US-China tensions after Trump removed Hong Kong’s special status earlier in the day.