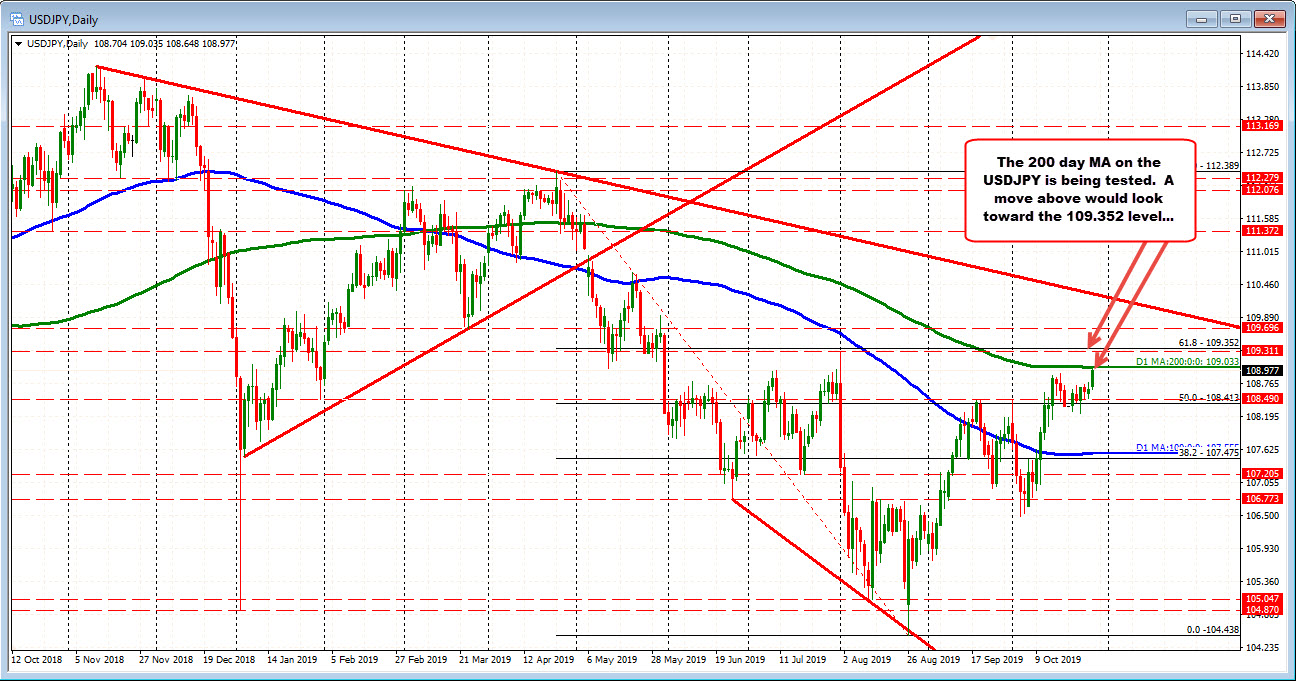

Tests old trend line support

The USDJPY failed on an earlier peek above its 200 day MA at 109.031 today. The high price traded above and reached a high of 109.063 before reversing lower. The price is trading back below the highs from October 15 and October 17 at 108.89-93 currently and down testing an old trend line at 108.89.

Admittedly, the price last week and this week did move below that old trend line on the 4-hour chart above, but those breaks did fail too. So if the price is able to extend below the trend line, the price will need to show some downside momentum that keeps the price below that line.

Drilling down to the 5 minute chart below, the look above the 200 day MA (see green line overlay at 109.03) was for less than a single 5 minute bar. The last two price runs higher have tested the 200 bar MA (green line) and the 100 bar MA (blue line) That keeps the bears intraday more in control. Stay below keeps the sellers more in control.

Yields are marginally lower. The US stocks are also marginally lower.