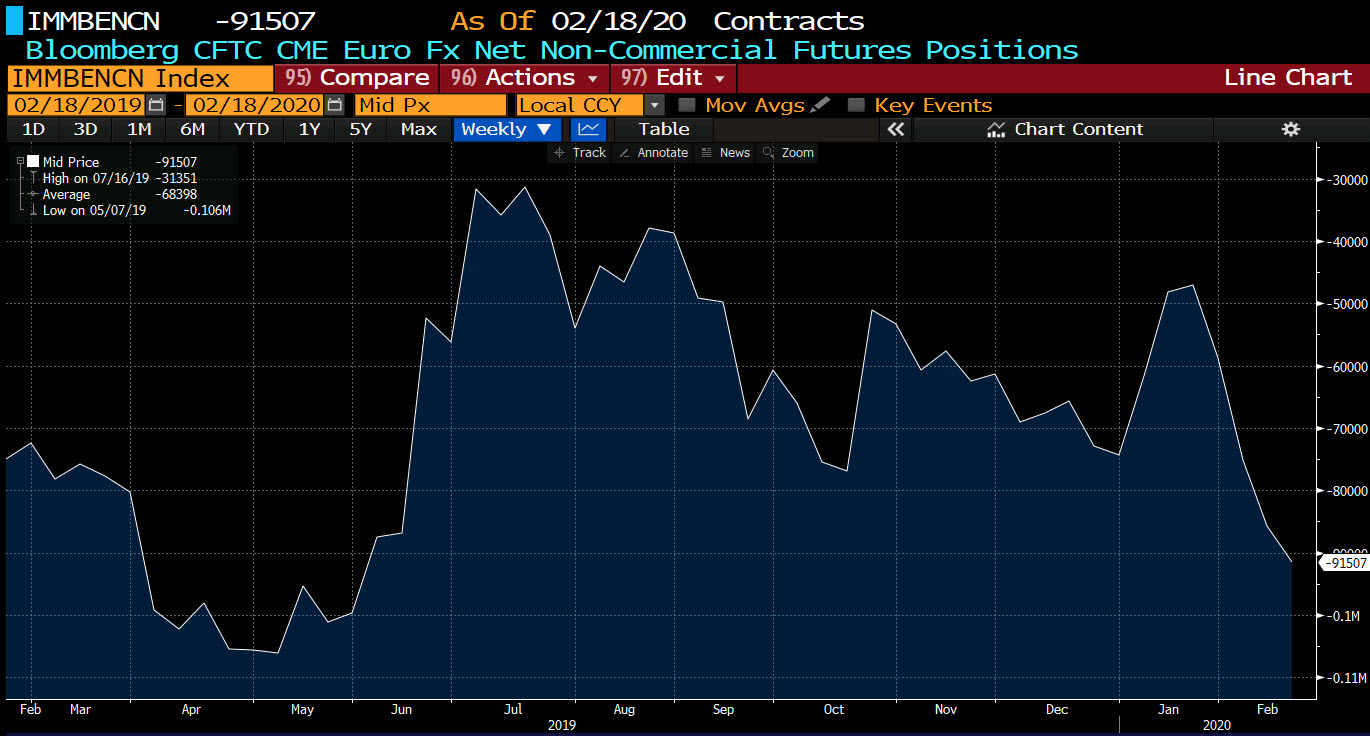

Forex futures net positioning data for the CFTC for the week ending February 18, 2020

- EUR short 92K vs 86K short last week. Shorts increased by 6K

- GBP long 29K vs 21K long last week. Longs increased by 8K

- JPY short 27K vs 26K short last week. Shorts increased by 1k

- CHF long 2K vs 4K long last week. Longs decreased by 2K

- AUD short 38k vs 33K short last week. Shorts increased by 5K

- NZD short 12K vs 4K short last week. Shorts increased by 8K

- CAD long 8k vs 10K long last week. Longs decreased by 2K

The EUR is the biggest position with the short at -92K from -86K last week. The shorts are winning as the price reached the lowest level since 2017 this week.