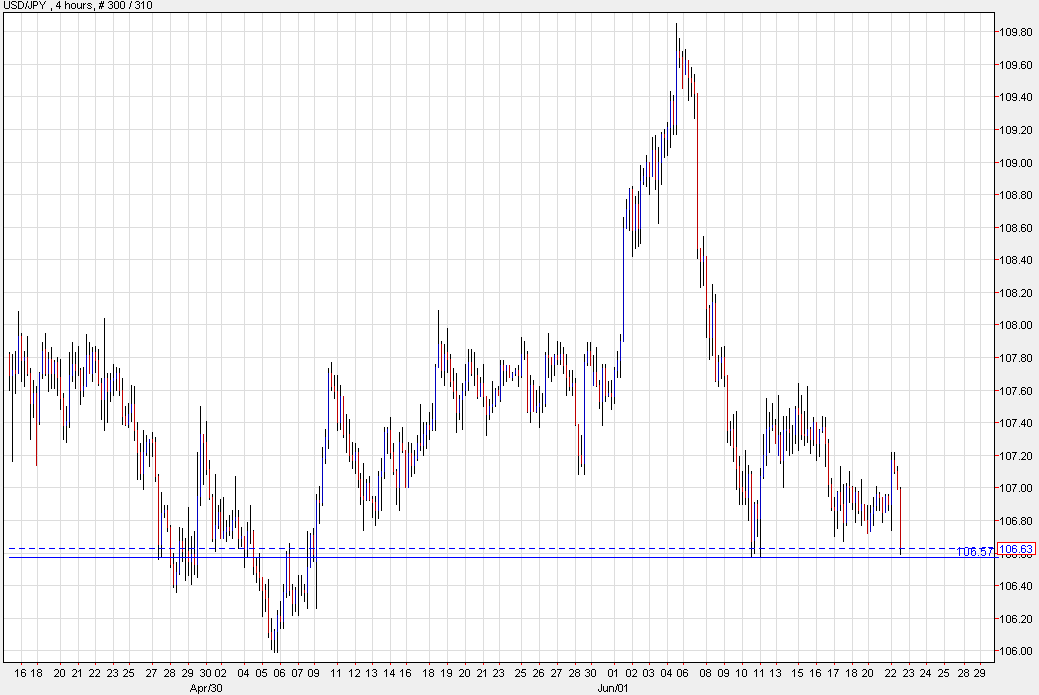

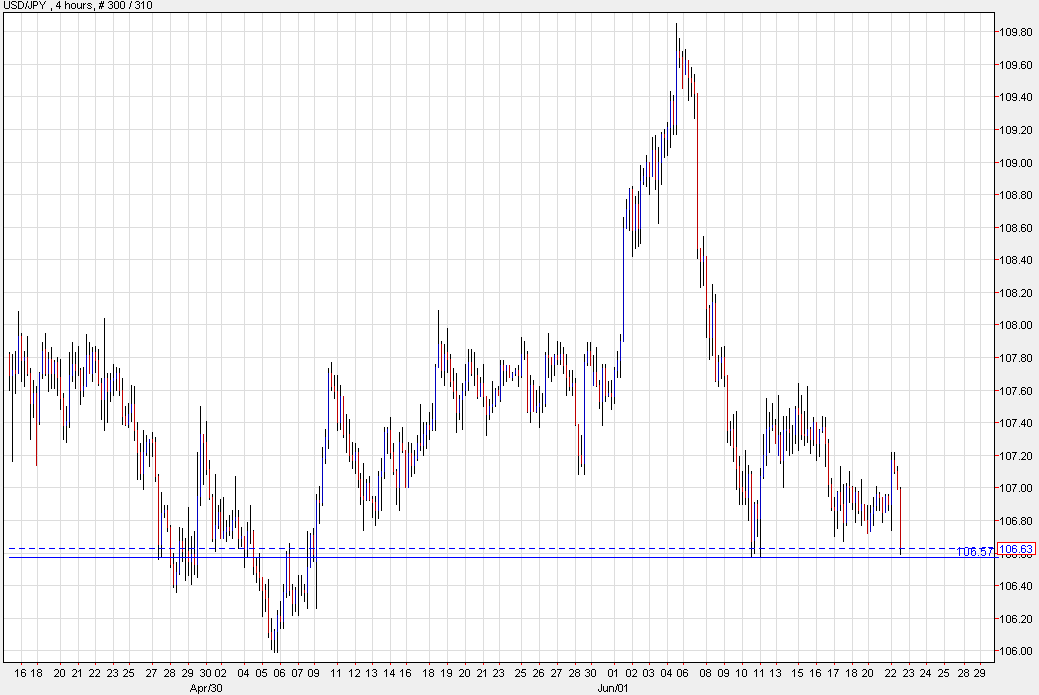

Big turnaround in USD/JPY

I was reading a piece on Bloomberg’s markets live blog saying that Brexit 2020 may well be a flop. The point it made was that Brexit in 2016 was a shock. We know that hardly anyone saw it coming and when it happened the GBP fell sharply lower.However, this time, markets have had years of pricing in the UK’s new role in the world.

A more ‘in the background’ role for the UK?

Europe has been pulling together its fiscal and monetary policy to try and support the whole eurozone. However, the UK and its assets have seen global repricing as the UK is re-assessed as a medium sized nation with uncertain trade arrangements. Rightly or wrongly, investors have been downgrading the UK’s prospects. Also, don’t forget that a number of companies are still planning on removing their Headquarters from London.

Is risk tilted to the upside for the GBP

So, even if the EU and the UK don’t arrange a deal this year is a no-deal Brexit virtually priced in? Although the GBP could be expected to fall lower on a no-deal Brexit is the GBP pretty much well placed for upside from current levels? The risk of further downside is still in play as long as a ‘no-deal’ is still a possibility. However, for traders taking a longer term approach with a 2-3 year timeframe then the outlook looks firmer for the GBP the longer the outlook.

Markets are just not acting right. They are misbehaving… It is time to take a little break and take a breathe

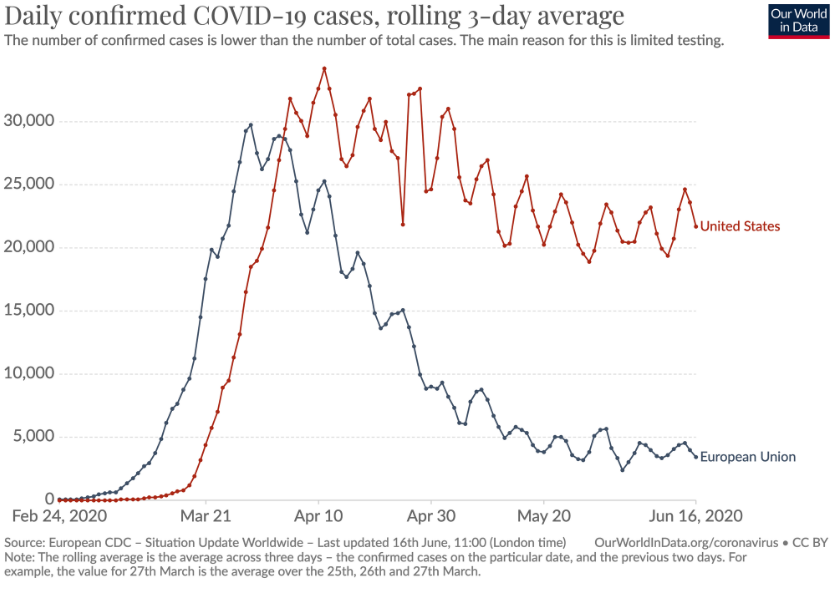

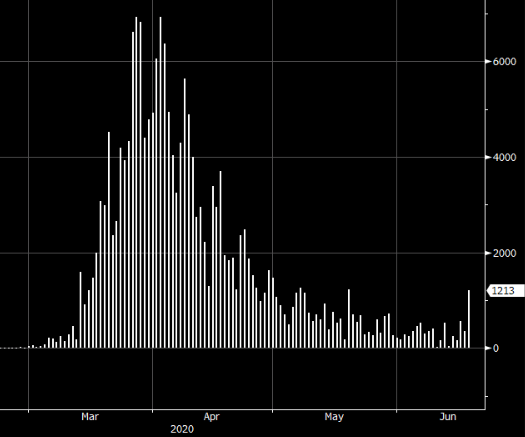

As China reacts to increases in coronavirus cases in Beijing and Florida spooked the market with a surge in their cases, the flow funds into the forex market has been into the US dollar.