A foreshadow to the BOJ meeting tomorrow perhaps?

- FY 2019 real GDP growth estimate lowered from 1.3% to 0.9%

- FY 2020 real GDP growth estimate of 1.2%

- FY 2019 consumer inflation estimate of 0.7%

- FY 2020 consumer inflation estimate of 0.8%

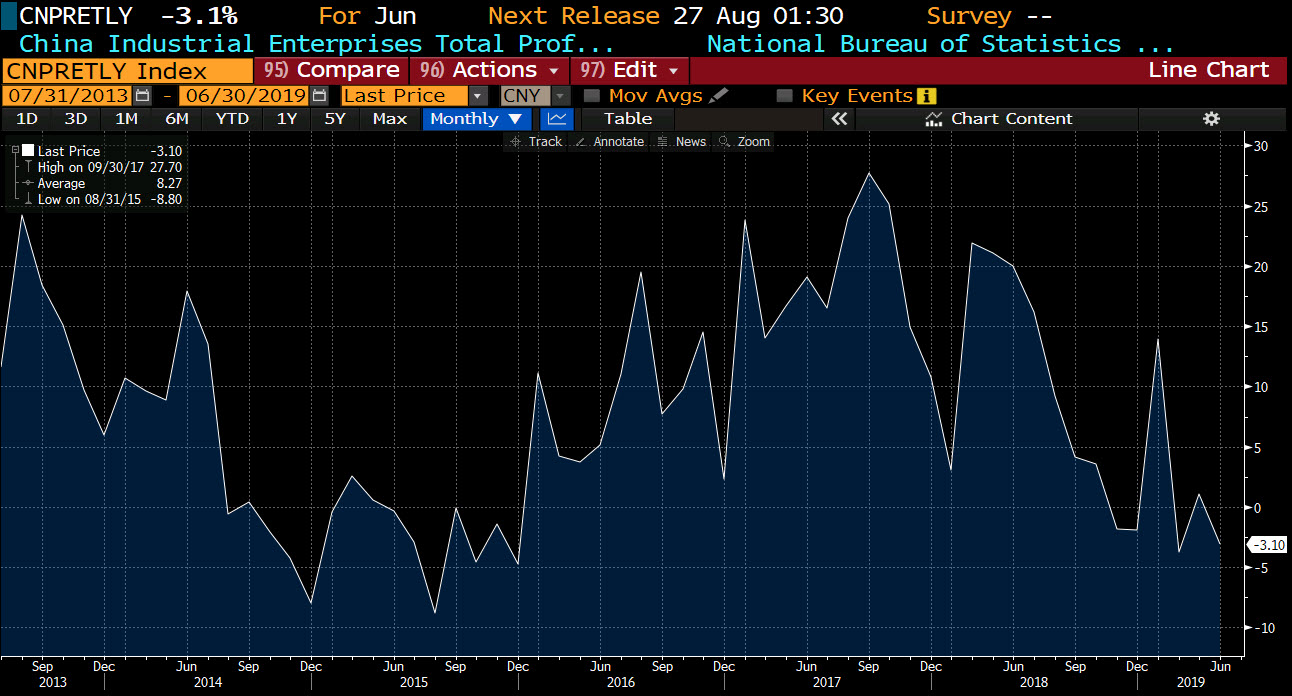

The rapid expansion of household debt in emerging Asian countries, particularly China, has become a risk to the global economy.

In Thailand and Malaysia, debt has ballooned due to booms in the auto and housing markets, and the growing repayment burden has dampened consumer sentiment. In China, household debt as a percentage of nominal GDP is now over 50%. Countries such as Thailand have begun curbing their consumption in response to rising debt levels.

The U.S. Federal Reserve is expected to cut interest rates at the end of this month. Emerging economies also have room for interest rate cuts, which would boost growth in the short run but could deepen the scars from indebtedness over the long term.

Somprawin Manprasert, chief economist at Bank of Ayudhya, pointed out that household debts have ballooned as a result of incentives for the purchase of cars and other items introduced by the Thai government in 2011. This is a structural factor that will weigh on future consumption, Somprawin said.

Thailand’s household debt ratio is close to 70%. That is higher than in Japan and other advanced economies, which have ratios of about 58%, and well above that of the eurozone. The main reason is auto loans. To support the car industry, the Thai government introduced tax incentives to encourage purchases, which took off in 2012. As a result of the higher debt load, personal consumption has been sluggish and inflation has been weak.