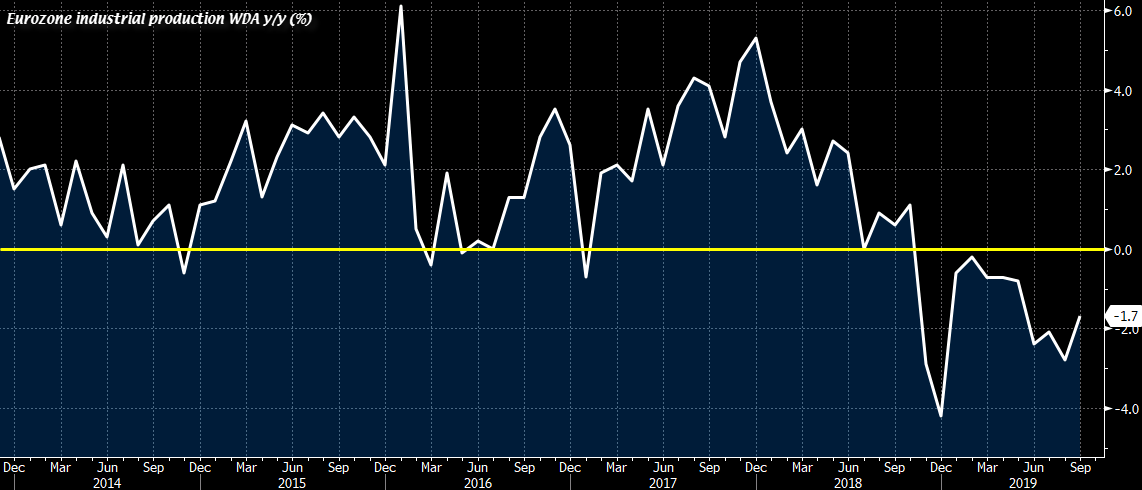

#Germany’s producer prices drop way faster than expected. PPI -0.6% in Oct YoY vs forecast of -0.4%, lowest since 2016.

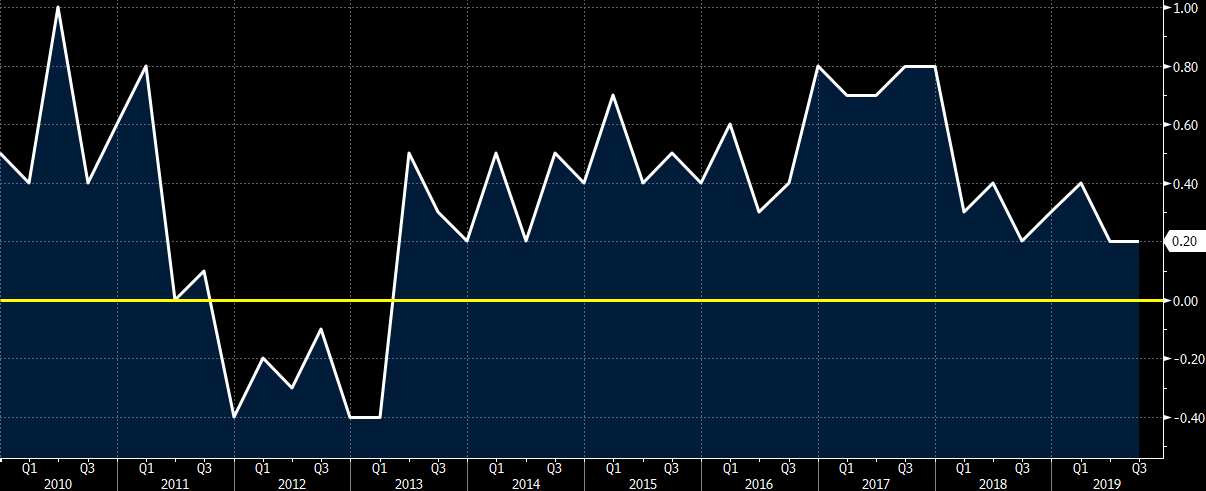

trade balance adjusted Y -34.7bn

exports -9.2% y/y – worse than expected and the biggest y/y fall in 3 years.

imports -14.8% y/y – not as bad as expected but not good, ditto on the biggest y/y fall in 3 years.