Will countries even consider lockdown measures a second time?

h/t @ tracyalloway

h/t @ tracyalloway

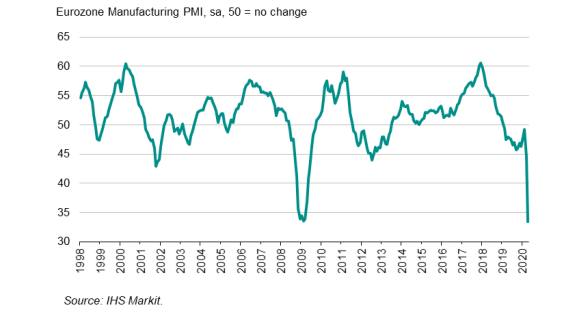

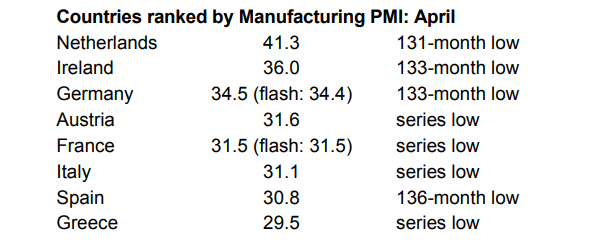

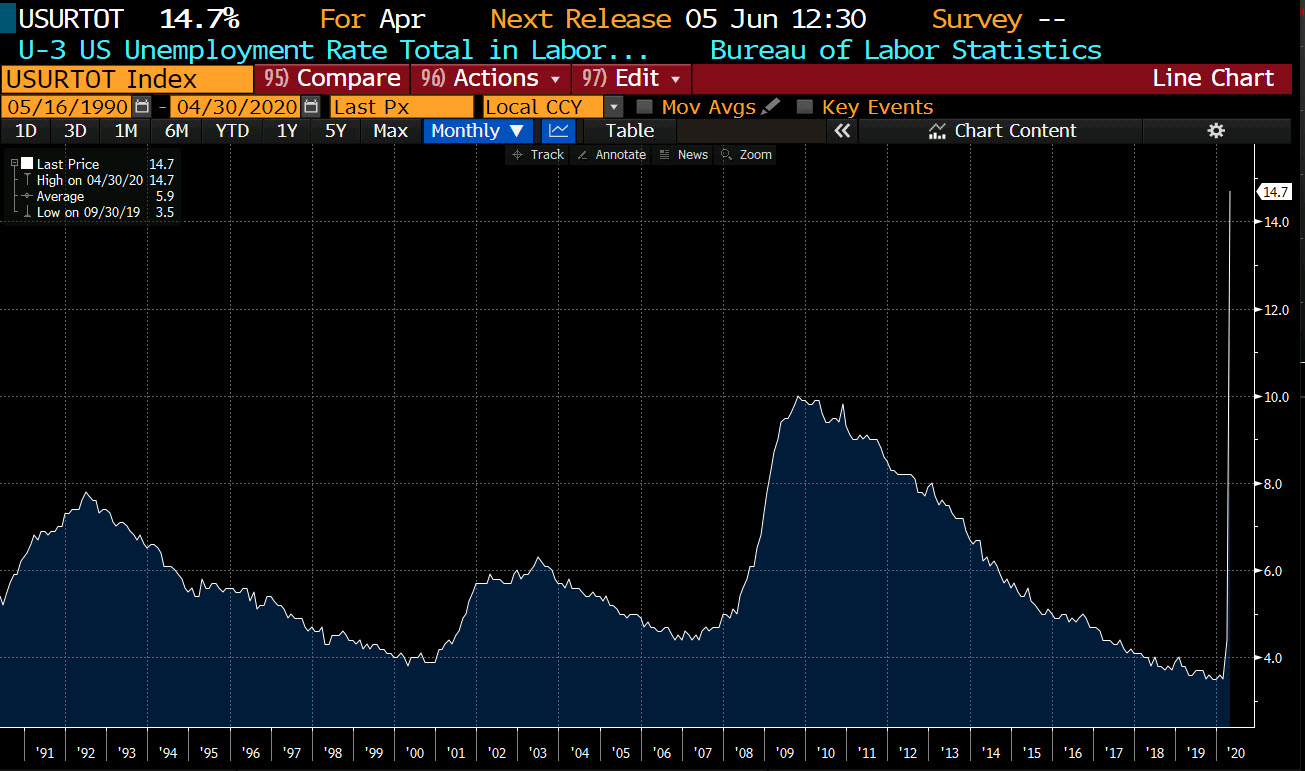

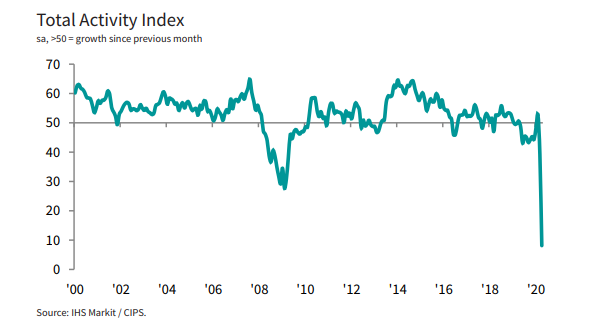

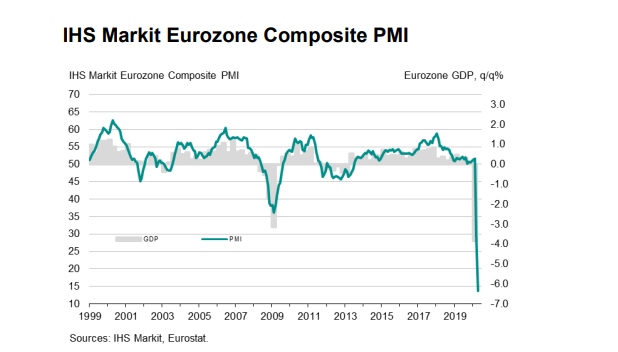

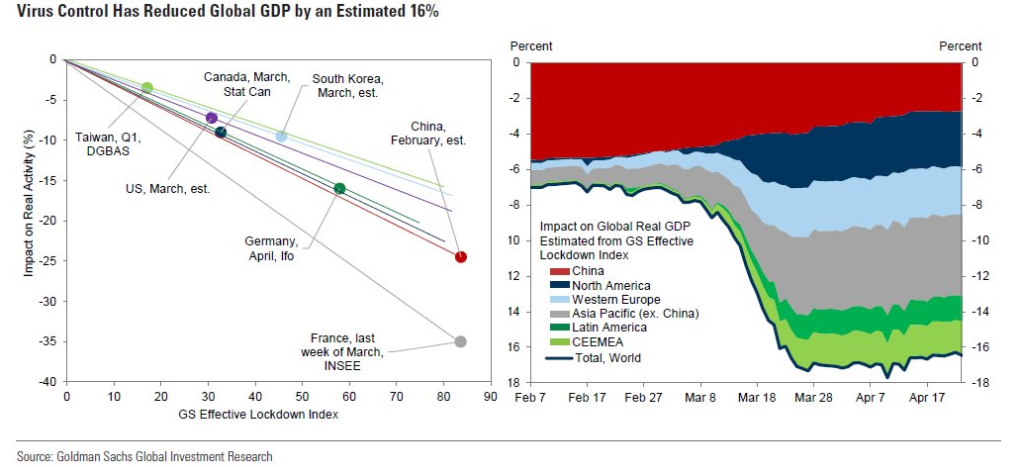

One of the most heated debates across the world still is whether or not the cure is more damaging than the disease itself. The cure of course being lockdown measures implemented by governments to contain the spread of the coronavirus.

You have to wonder, if we are on the cusp of a secondary outbreak in some major economies, can governments so easily make a decision to go into lockdown again?

As much as it is a health concern, the political pressures from an economic perspective could be a major consequence for a lot of governments if we do see such a scenario happen.

Just some food for thought. But yes, as warranted as the lockdown measures are to contain the spread and to not overburden medical capacity, it does come with a heavy cost.

h/t @ tracyalloway

h/t @ tracyalloway