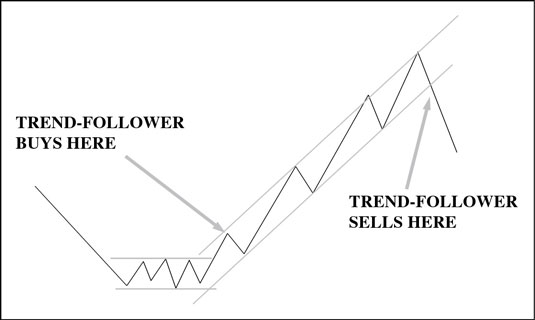

Trend following is a trading strategy that involves identifying and following the direction of market trends. Some advantages of trend following include:

Trend following is a trading strategy that involves identifying and following the direction of market trends. Some advantages of trend following include:

- It can be profitable in both rising and falling markets.

- It can be applied to a variety of markets, including stocks, bonds, commodities, and currencies.

- It can help to reduce risk by only taking trades in the direction of the trend.

- It can be automated, which can save time and reduce emotional biases.

However, it’s important to note that no trading strategy is without its drawbacks, and trend following is no exception. Some disadvantages include:

- It can generate significant losses during periods of market consolidation or range-bound markets.

- It may result in missed opportunities if the trend changes direction quickly.

- It may cause over-trading and high transaction costs.

It’s important to understand the advantages and disadvantages of any trading strategy before implementing it.