10-year yields down 10 bps to below 1.55% on the day

Fears surrounding the new COVID-19 variant is dominating markets at the moment and bonds are very much bid amid a flight to safety.

The drop in 10-year yields today reverses all the hard work by bond sellers this week and while the move is sizable, it comes with some caveats.

One, thinner market conditions may be exacerbating the drop in yields. Two, this throws a curveball to the straightforward narrative that central banks can easily look to rate hikes to counteract surging inflation pressures.

The latter issue may be irrelevant if the new COVID-19 variant proves to be a non-threat in the weeks ahead but we will see. As such, it offers a new element that traders have to consider amid the ongoing inflation debate looking to next year.

Elsewhere, even 2-year yields are down by 8 bps on the day and look set for its worst one-day drop since March last year (at least in terms of bps):

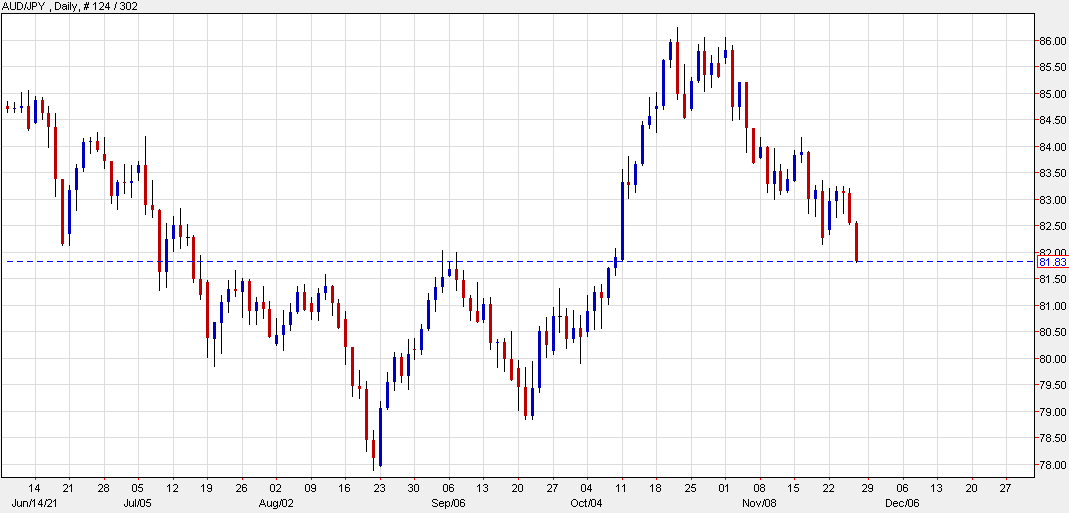

The drag in yields is also putting further pressure on yen pairs with USD/JPY falling to fresh lows on the day just below 114.50 at the moment.