Softness in the risk trades adds another leg to the move

The loonie and New Zealand dollar are carving out fresh lows against the US dollar after the Nasdaq dive weighed on broader sentiment. The loonie is also navigating a possible US SPR release.

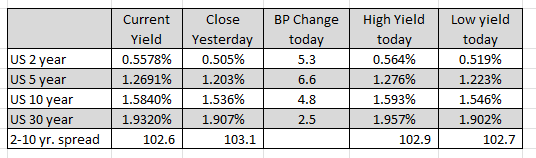

The driving force behind the dollar strength today is the re-nomination of Jerome Powell as Fed chair. That’s pushed US 2-year yields up 6.9 bps to 0.574% on expectations he will be more hawkish than Brainard would have been.

That belief will be tested in time but it fits nicely into the current theme of US dollar. It’s been a one-way march higher in the dollar for weeks as the market prices in divergence with the ECB, BOJ and others.

In terms of today’s move, NZD/USD has fallen to a fresh low since October 12 and a minor uptrend is going to be tested soon. Beyond that are the Sept and Aug lows.