Archives of “November 21, 2021” day

rssAn Update : #FAANG #TSLA #MU #NVDA #NKE #MSFT #INTC -#AnirudhSethi

To read more enter password and Unlock more engaging content

An Update : #WTI #BRENT #NATURALGAS -#AnirudhSethi

To read more enter password and Unlock more engaging content

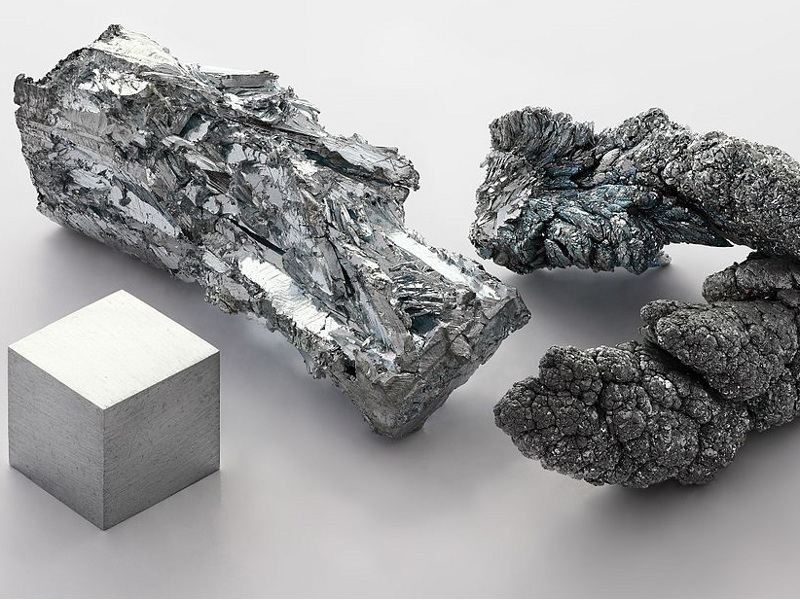

An Update : #COPPER #ZINC #LEAD #TIN #NICKEL #Aluminium #Steel #IronOre -#AnirudhSethi

To read more enter password and Unlock more engaging content

An Update : #GOLD #SILVER #PALLADIUM #PLATINUM -#AnirudhSethi

To read more enter password and Unlock more engaging content

The YTD performance of the 7 biggest stocks Down pointing backhand index. $NVDA has been catching up in stride.

One of the craziest, saddest stories from the 1960s space race:

Port of Seattle. No ships waiting, tons of empty space

Japanese Prime Minister Kishida confirms his government is considering an oil reserve release

Japan PM Kishida over the weekend:

- We’re proceeding with consideration as to what we can do legally on the premise that Japan will coordinate with the United States and other countries concerned

- We want to draw a conclusion after thoroughly considering the situation each country faces and what Japan can do

Japanese legislation enables a reserve release only when supply is constrained or at a time of natural disasters. It’ll take some argument to allow a release merely to combat high prices, but I’m sure if such arguments need to be made they will be. I’ll leave that one up to the lawyers.

Central bank watch: Will the Fed stay flexible?

Central bank rundown

Good morning, afternoon and good evening one and all! It’s time for your central bank catch up. So, if you have been out of the loop, or just want a quick refresher, then grab a coffee and let me get you up to speed. We will look at the remaining four major central banks tomorrow.The link to the latest statement is at the bottom of each section, so just click there to read the bank’s central statement. Remember, there is no substitute for actually reading a central bank statement yourself and it will almost certainly be of great benefit to your trading.Finally, some advance notice. On Thursday and Friday of this coming week I will be covering the North America session over Thanksgiving. So, will see you then as I keep the seat warm over the holiday. Right ho – read on below for your latest central bank run down.Reserve Bank of Australia, Governor Phillip Lowe,0.10%,Meets 07 DecemberUncertainty reignsIn the October 05 meeting the RBA indicated that they had hit rock bottom, that peak ‘bleakness’ had been reached.The impact from falling Iron ore prices, China’s slowdown in growth, the Evergrande crisis, as well as the delta variant locking down parts of the country all left their mark on the Australian economy. In November’s meting the RBA’s decision tried to balance a few things as they did concede that interest rates could now rise in 2023. Remember that the RBA had previously stated that interest rates would not rise until 2024.- Firstly, as expected, they kept rates unchanged at 0.10 bps

- Asset purchases remain being purchased at the same rate of $4 bln per week.

- They finished their yield target of 0.10 bps for the April 2024 Australian Government bond.