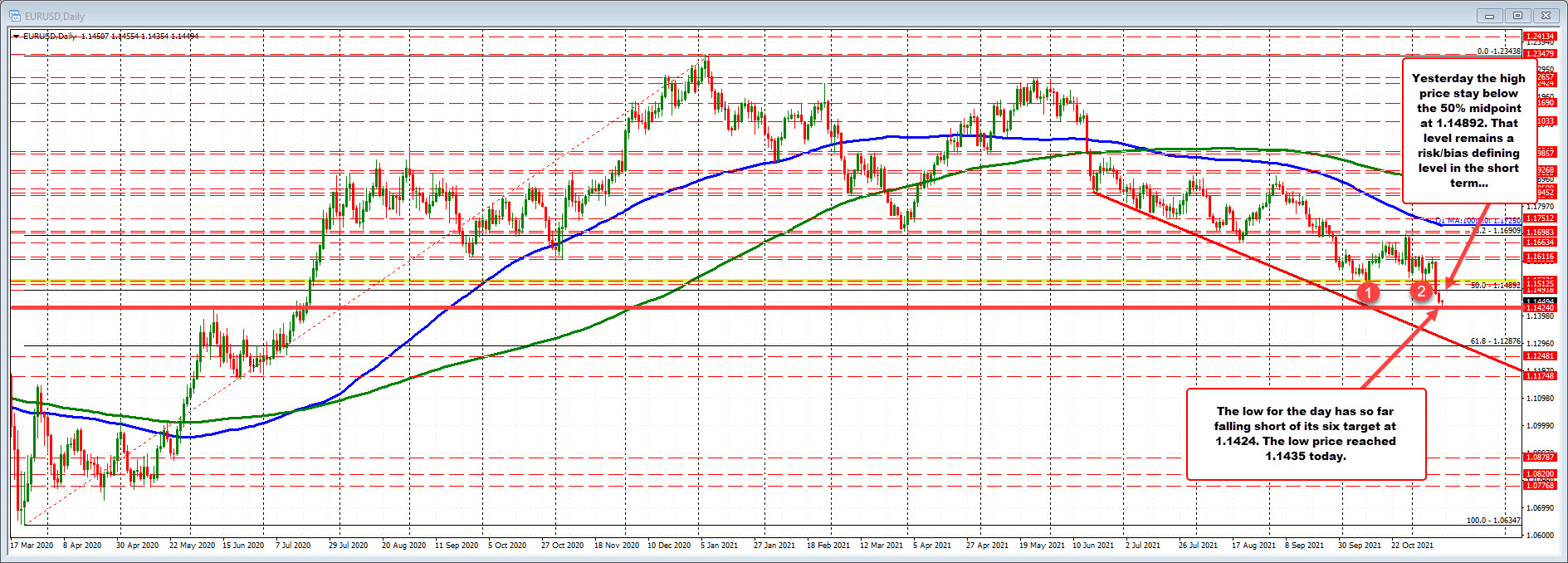

Still below the 50% midpoint

The EURUSD is trading in a narrow 20 pip trading range as the week worked its way toward a close. This week saw the pair move higher on Monday and Tuesday into resistance between 1.1601 and 1.1611. On Wednesday the price moved sharply lower in response to the dollar buying after the CPI data, and in the process, cracked below the 50% midpoint of the move up from the March 2020 trading low at 1.14892. During yesterday’s trade the high price stayed below that midpoint level keeping the bears in control. The price closed near it’s lows at 1.1442.