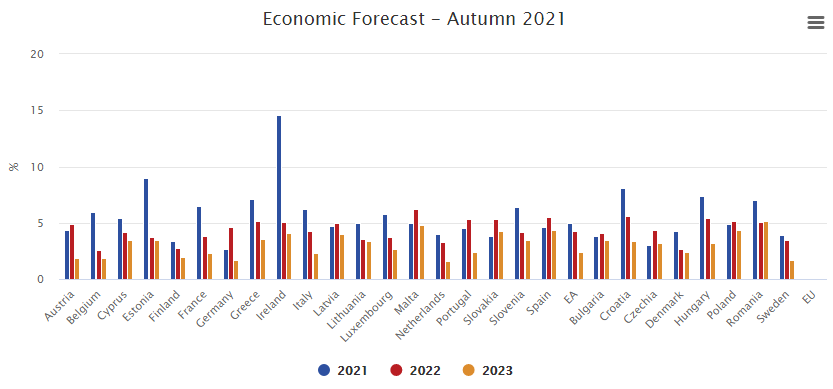

The EU releases its latest projections on the euro area economy

- 2021 growth seen at 5.0% (previously 4.8%)

- 2022 growth seen at 4.3% (previously 4.5%)

- 2023 growth seen at 2.4%

- 2021 inflation seen at 2.4% (previously 1.9%)

- 2022 inflation seen at 2.2% (previously 1.4%)

- 2023 inflation seen at 1.4%

On the economic outlook, the Commission noted that the new headwinds are mounting as supply-side challenges continue to persist and surging energy prices look set to weigh on consumption and investment.

As for inflation, they see it peaking at 3.7% in the final quarter of this year and to continue recording “high prints” in 1H 2022 before declining and then stabilising by 2023.