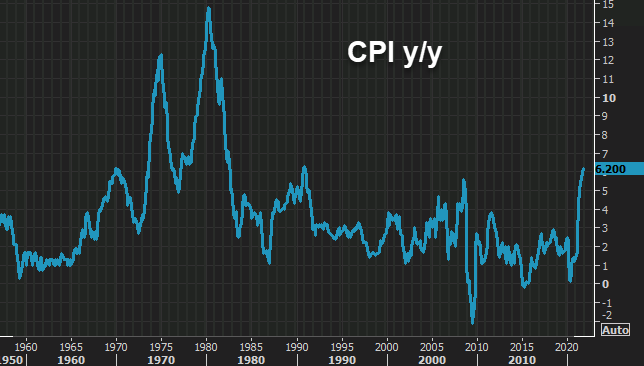

US October 2021 consumer price index data

- Highest since 1990

- Prior was 5.4%

- m/m CPI +0.9% vs +0.6% expected

- Prior m/m reading was +0.2%

- Real weekly earnings -0.9% vs +0.8% prior

Core inflation:

- Ex food and energy +4.6% vs +4.3% y/y expected

- Prior ex food and energy +4.0%

- Core m/m +0.6% vs +0.4% exp

- Prior core m/m +0.2%

- Full report

Note on the consensus numbers: I’ve seen some different estimates that were mostly lower than what I have here. So the numbers beat the estimates but perhaps by even more than is shown here.

The US dollar has jumped on the headlines around 20 pips across the board.

More details:

- CPI food +0.9% m/m

- Housing +0.7% m/m

- Owners’ equivalent rent +0.4%

- CPI energy +4.8%

- Gasoline +6.1%

- New vehicles +1.4%

- Used cars +2.5%

Credit Suisse said a rise in housing of more than 0.5% would be a potential signal of more persistent inflation.