Dollar at the lows of the day

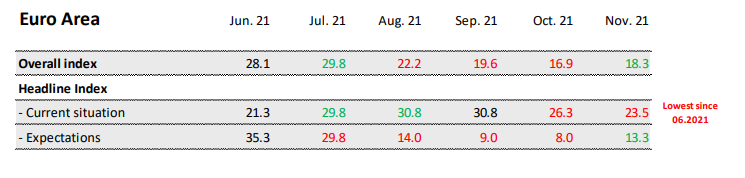

Euro area investor morale climbed for the first time since July as investors appear to expect that supply bottlenecks and higher prices to hold back the economy temporarily.

“Supply bottlenecks and high inflation are causing problems for companies and are having a certain braking effect. However, investors only expect a temporary burden and are therefore somewhat more confident about the next six months.”

The Fed met this week and tapered as expected to the tune of $15 billion per month.The slight shift was that the Fed was going to be ‘flexible’ around the timing for the end of asset purchases. This was a nod to the rising inflation pressures seen around the world and the Fed assuring markets it would act if necessary to curb rising inflation. However, in the press conference, the Fed stressed that they would be ‘patient’ before hiking rates.

The key points

The takeaway

Similar to the RBA the Fed have been hawkish in deed, and dovish in action. They have been hawkish by tapering flexibly and communicating that the Fed will communicate to markets if they have to alter the pace of tapering. However, with a dovish stance of ‘patience’ on hiking rates. It is arguable that the Fed has kept open the opportunity to hike rates in the middle of June 2022. However, like with the RBA, two important metrics going forward for the Fed are going to be inflation and employment. The Fed has stressed patience on both jobs and inflation for now. However, significant moves in either of these two metrics will result in the Fed thinking again. Be prepared.

The sharp move lower in bond yields post the FOMC as markets price out aggressive rate hikes means gold could find some decent upside, so worth looking out for.