Archives of “October 26, 2021” day

rssTop 10 emerging jobs in 2022:

Euro Stoxx 600 index closes at a new all time high

Major European indices close higher

The Euro stocks 600 index is set to close at a new all-time high. The index is up 0.8% and above the previous high of 475.84.

Other indices in Europe are also higher on the day with the provisional closes are showing:

- German DAX, +1.1%

- France’s CAC, +0.9%

- UK’s FTSE 100, +0.8%

- Spain’s Ibex, +1.0%

- Italy’s FTSE MIB +0.6%

In other markets as European traders look to exit:

- Spot gold is down $19.15 or -1.05% at $1788.12

- Spot silver is down $0.60 -2.46% at $23.96

- WTI crude oil futures are up $0.66 or 0.79% at $84.42

- bitcoin is trading above and below $62,000

In the US stock market, the major indices are coming off their high levels but still higher on the day. The S&P and Dow industrial average traded to a new intraday all-time high prices:

- Dow, +112.37 points or 0.32% at 35854.82. It new all-time high comes in at 35892.92

- S&P index up 23 points or 0.5% at 4589.74. Its new all-time high comes in at 4598.53

- NASDAQ index is up 86.6 points or 0.59% at 15316.62. It’s high price reached 15384.00. That’s 19 points lower than the all-time high of 15403.44

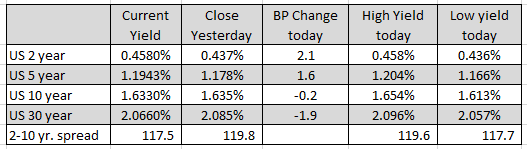

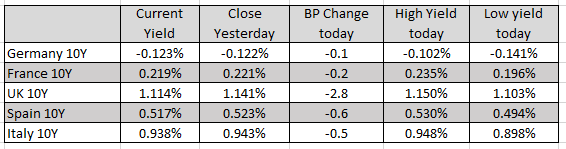

In the US debt market, yields are mixed with the short run higher in the longer end lower (flatter yield curve):

In the European debt market, the benchmark 10 year yields are lower on the day:

A snapshot of the foreign-exchange market has the AUD as the strongest of the majors while the JPY is the weakest.

The Largest Oil and Gas Companies in the World, 2021 (by Market Cap, billions)

4 types of wealth :

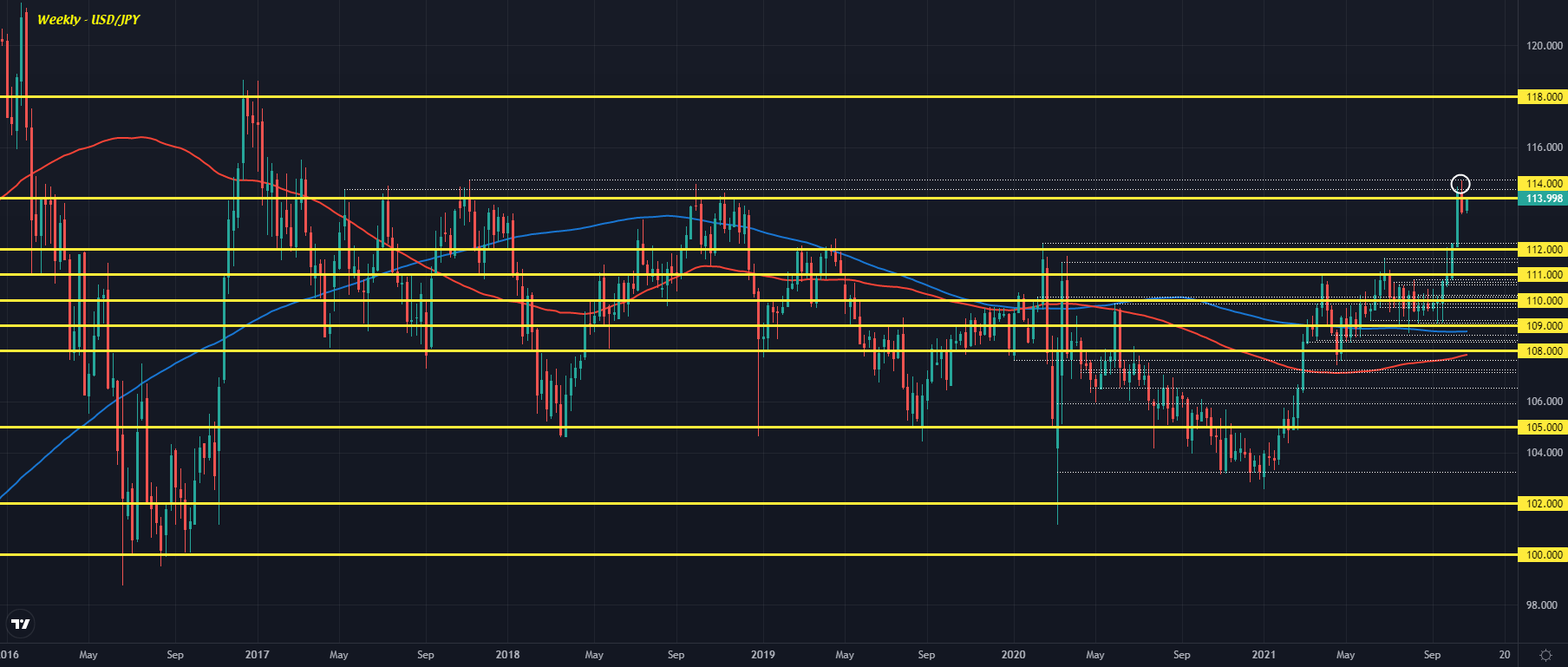

USD/JPY brushes against the 114.00 level again to start the session

USD/JPY trades up to test the 114.00 level

The yen is the laggard to kick start the session as the rest of the major currencies bloc are keeping steadier for the most part amid lighter trading conditions so far.

USD/JPY is seen pushing up to 114.00 again with the risk mood also keeping more positive as we get things underway in European trading. Of note, the pair is now contesting near-term resistance from its key hourly moving averages at 113.93-00.

Hold a break above and the near-term bias switches to being more bullish instead. That will be a key focus area to watch with little else for traders to work with.

While a push above 114.00 may entice buyers to have more conviction, the weekly chart underscores that more work needs to be done for the upside momentum to extend:

The break above 114.00 two weeks ago was encouraging but gains last week fell short of contesting and breaching the November 2017 high of 114.74, resulting in a light pullback coming into this week.

As such, that will remain a key resistance level/region to watch if buyers can seize back near-term control – in terms of justifying any further extensive breakout.

A single $TSLA share in 2030.

AUD/USD swinging about, iron ore prices in China also

Correlation is not causation and all that … yep.

Iron ore futures in Dalian had opened up circa 1% in morning trade which seemed to give a tailwind the Australian dollar., They’ve since dropped into negative, and AUD is slipping from its highs now.

Speaking of China markets, coal is dropping hard again today. Its had a run of 4 days down, this would be 5 if it continues.

AUD/USD:

United States Grand Prix Attendance 2018: 264,000 2021: 400,000 (+51%)

China power shortages – fear of global car production halt within weeks

Power shortages in China, specifically in Shaanxi and Shanxi provinces, are leading to shortages of magnesium.

Those two provinces are the world’s main magnesium production hubs

- 25 plants had to shut down

- 5 further plants cut production by 50%

Magnesium is a key material used in the production of aluminium alloys,

- used in the production of car parts, building materials and more

- China produces more than 85% of the world’s supply

The reports have been around for a week or more but fears are ramping up further. Check out this (ungated) report, which highlights:

- “A magnesium shortage could trigger a shortage of [usable] aluminium, which in turn could also hit car production,” BofA Securities analysts told clients last week,