Archives of “October 1, 2021” day

rssEuropean equity close: Soft start to the new month

Rough week for equity markets:

- UK FTSE 100 -1.0%

- German DAX -0.9%

- French CAC -0.4%

- Spain IBEX +0.2%

- Italy MIB -0.7%

- UK FTSE 100 -0.3%

- German DAX -2.3%

- French CAC –1.8

- Spain IBEX -0.9%

- Italy MIB -1.3%

Rating agency Fitch says debt limit brinksmanship could put AAA rating at risk

Stocks react negatively

Rating agency Fitch is out saying that the debt limit brinksmanship could put US AAA rating at risk.

- Failure of latest efforts to suspend US government debt limit indicates current stand off could be among the most protracted since 2013

- Nevertheless it believes that US debt limit will be raised or suspended in time to avert a default event

- If US debt limit were not raised or suspended in time, political brinksmanship and reduce the financing flexibility could increased risk of sovereign default

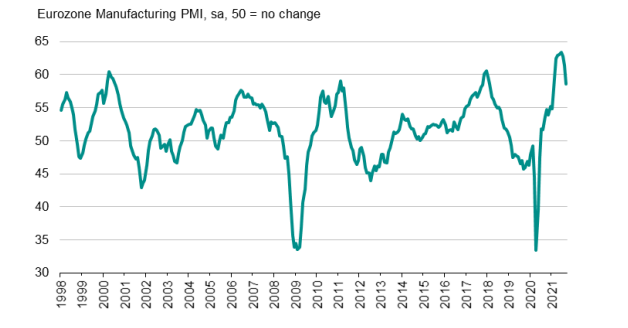

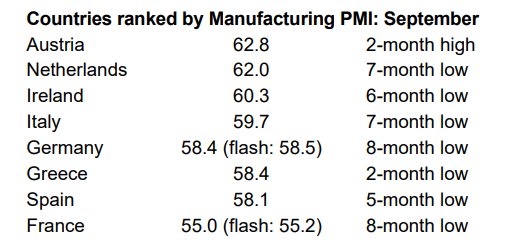

Eurozone September final manufacturing PMI 58.6 vs 58.7 prelim

Latest data released by Markit – 1 October 2021

“While Eurozone manufacturing expanded at a robust pace in September, growth has weakened markedly as producers report a growing toll from supply chain headwinds.

“Supply issues continue to wreak havoc across large swathes of European manufacturing, with delays and shortages being reported at rates not witnessed in almost a quarter of a century and showing no signs of any imminent improvement.

“Growing supply and transport issues are not only being cited as a major constraint on both production and demand, but also once again drove prices sharply higher in September.

“Factory jobs growth has meanwhile also slowed partly due to lower labour requirements amid the widespread component shortages.

“With costs rising and factories struggling to produce enough goods to meet customer demand, the average price of goods leaving the factory gate rose at an increased rate in September, accelerating to almost match the record price jumps seen earlier in the summer.

“The supply situation should start to improve now that COVID-19 cases are falling and vaccination rates are improving in many countries, notably in several key Asian economies from which many components are sourced, but it will inevitably be a slow process which could see the theme of supply issues and rising prices run well into 2022.”

Trading Secret Seminar :Rare Opportunity for 500 Traders on 15th/16th Oct ,Place #Baroda #AnirudhSethi

TRADING IS WAR .PREPARE YOUR WEAPON

ALERT :

►Be Ready to join me personally on 15th or 16th Oct 2021

►Only 500 TRADERS (Life changing :Yes Trading Life will be changed )

►Enroll before 5th Oct 2021

►Greatest secrets :Once in life time

►Once u join for Day (one to one interaction )

►Never revealed in my Life time (Yes once u get these secrets )

↓

#BOXCHART (For Trading range with price Targets accuracy will cross 95% )

Two Indicators :Just Plot these ►Nothing else u need on chart ( Fastest Buy and Sell signal in world for Traders ,Swing Traders

Trend Followers )

#TGD +#BB Secret +#MA Secret (Nobody knows it’s our challenge )

+

Will Guide your for 90 days !!

Just send e-mail

(Yes to get Price and more Details )After Email TALK to me personally first.

IamAnirudhSethi @Gmail.com

5th Oct ►Last Day to Enroll

Jesse Livermore. Nicolas Darvas

Profit always take of themselves but losses never do”-Nicolas Darvas

Still to come – US House votes on infrastructure (after 10pm local time)

US Lower House Speaker Nancy Pelosi has said she is still working towards reaching an agreement around the circa $3.5 trillion infrastructure bill.

- “We’re on a path to win the vote”

- “I don’t want to even consider any options other than that.”

S&P 500 companies have $ 2.4 trillion in cash on their balance sheets. This represents about 5.5% of total assets.

Bank of Japan quarterly Tankan report

The BOJ’s Tanki Keizai Kansoku Chousa (Tankan) reports on the Short-Term Economic Survey of Enterprises in Japan

- September big manufacturers index +18(Reuters poll: 13)

- December big manufacturers index seen at +14(Reuters poll: 15)

- September big non-manufacturers index +2(Reuters poll: 0)

- December big non-manufacturers index seen at +3(Reuters poll: 5)

- September small manufacturers index -3(Reuters poll: -9)

- December small manufacturers index seen at -4(Reuters poll: -6)

- September small non-manufacturers index -10(Reuters poll: -11)

- December small non-manufacturers index seen at -13(Reuters poll: -9)

- Japan all firms see dollar averaging 107.64 yen for fy2021/22

- Japan all firms see euro averaging 126.50 yen for fy2021/22

- Japan big manufacturers see dollar averaging 106.72 yen for fy2021/22

- September all firms employment index -17

- September all firms financial condition index +11 vs june +11

- September big manufacturers’ production capacity index +1 vs june +1

- Japan big manufacturers see fy2021/22 recurring profits +12.7%

- Japan big firms see fy2021/22 capex +10.1% (Reuters poll: 9.1%)

- Japan small firms see fy2021/22 capex +4.7% (Reuters poll: 1.6%)

- BOJ September tankan corporate price expectations survey: Japan firms expect consumer prices to rise 0.7% a year from now vs +0.6% in prev survey

- Japan firms expect consumer prices to rise an annual 1% 3 years from now vs +0.9% in prev survey

- Japan firms expect consumer prices to rise an annual 1.1% 5 years from now vs +1.1% in prev survey