For the week, the major indices close with gains

The major European indices are closing the day with declines, but for the week, they held on to gains.

The provisional closes are showing:

- German DAX, -0.8%

- France’s CAC, -1.0%

- UK’s FTSE 100, -0.35%

- Spain’s ibex -0.1%

- Italy’s FTSE MIB -0.4%

For the trading week, the major indices closed higher:

- German DAX, +0.25%

- France’s CAC +1.0%

- UK’s FTSE 100 +1.3%

- Spain’s ibex, +1.3%

- Italy’s FTSE MIB +1.0%

in other markets as London/European traders look to exit shows:

- Spot gold is trading up $9.30 or 0.54% at $1752.30

- Spot silver is trading down six cents or -0.27% at $22.43

- WTI crude oil futures are trading up $0.42 or 0.57% $73.72. The low price today extended down to $72.81 before rotating back to the upside

- Bitcoin is down $-3200 and $41,700

US stock market, the NASDAQ index continues to be the laggard. The Dow Jones and S&P have traded above and below unchanged but are currently back in the red:

- Dow Jones -48.95 points or -0.14% at 34,717. The high reached up 92.24 points or 0.27%

- S&P index -5.46 points or -0.12% 4443.50. The high reached 4455.78, up 6.8 points or +0.15%

- NASDAQ index is down 66 points or -0.44% at 14985. It’s high price reached 15003.60 but that would still down -48.6 points or -0.32%

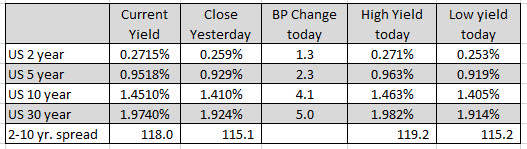

In the US debt market, the premarket high yield of 1.452% the 10 year was surpassed at 1.463%. The low yield today reach 1.405% before rotating back to the upside. Other yields are also higher with the 30 year up 5.0 basis points and the two year up 1.3 basis points.

The NASDAQ is up for the third day.

The NASDAQ is up for the third day.