Archives of “September 13, 2021” day

rss#litecoin #ltc looks like the skyscraper Burj Khalifa in Dubai

OPEC forecasts global oil demand will exceed pre-pandemic levels in 2022

OPEC monthly report is out

- Sees world oil demand next year rising 4.15 Million Bpd versus 3.28Mln in prior monthly report but 4.2 mbpd at Sept OPEC+ meeting.

- Sees demand at 100.8 mbpd next year, exceeding pre-pandemic levels

- August oil output rose 150k bpd (less than the 400k bpd increase in quotas)

- Keeps 2021 full year demand growth virtually unchanged at 5.96 mbpd

- 2021 non-OPEC supply lowered by 170 kbpd due largely to outages in gulf of Mexico

- Says oil demand in 3Q21 has proved to be resilient

- Global economic growth forecasts for both 2021 and 2022 remain unchanged from the last month’s assessment at 5.6% and 4.2% respectively

- OECD oil stocks were 57 million barrels below the five-year avg

20 years after the terrorist attacks on New York City’s World Trade Center of Sept 11, 2001, at least 22,000 civilians have been killed in U.S. airstrikes during the war on terror, mainly in Afghanistan, Iraq and Syria

German economy ministry says GDP growth to pick up significantly in Q3

Remarks by the German economy ministry

- Q3 GDP growth to pick up significantly after 1.6% q/q growth in Q2

- GDP growth likely to normalise in Q4

Peak conditions in the early stages of the summer sets up a good look for Q3 performance but the latter stages are pointing to moderation in overall conditions, even more so in the outlook as optimism fades and pent-up demand abates.

While a return to renewed virus restrictions may not be on the cards, there are still worries on the spread of the delta variant which is keeping a cloud over the outlook in Q4.

German economy ministry says GDP growth to pick up significantly in Q3

Remarks by the German economy ministry

- Q3 GDP growth to pick up significantly after 1.6% q/q growth in Q2

- GDP growth likely to normalise in Q4

Peak conditions in the early stages of the summer sets up a good look for Q3 performance but the latter stages are pointing to moderation in overall conditions, even more so in the outlook as optimism fades and pent-up demand abates.

While a return to renewed virus restrictions may not be on the cards, there are still worries on the spread of the delta variant which is keeping a cloud over the outlook in Q4.

China’s Yunnan province orders cement industry to reduce September output by more than 80% from August levels

China cracks down further on the materials industry in its bid to reduce emissions and conserve power

There is just so much regulatory involvement in Chinese industries right now that it is getting tough to keep up with the headlines. The latest move by Yunnan here is part of China’s efforts to curb steel production in order to cut emissions.

Demand conditions are expected to keep up but China’s continued crackdown (which had begun since earlier this year) on supply is seeing prices shoot higher now.

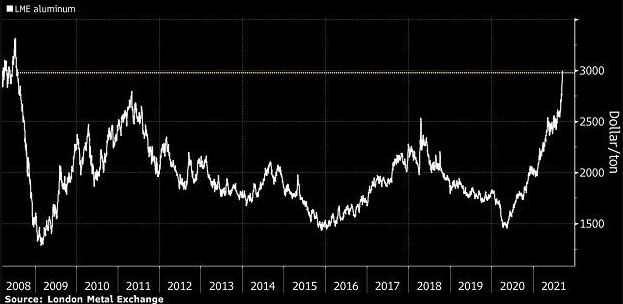

Aluminium hit $3,000 for the first time since 2008 and the headlines above won’t help to ease the upside pressure on prices, with Yunnan roughly hosting 60% of the industry’s new capacity this year, according to a Huajin Securities report.

The cement industry is also one that is targeted heavily as it accounts for 83% of carbon emissions from the non-metals construction materials sector.

Pentagon response to North Korea missiles – a threat to region

US response now:

- We are aware of reports of DPRK cruise missile launches.

- We will continue to monitor the situation and are consulting closely with our allies and partners.

- This activity highlights DPRK’s continuing focus on developing its military program and the threats that poses to its neighbors and the international community.

- The U.S. commitment to the defense of the Republic of Korea and Japan remains ironclad.

Fed’s Harker says FOMC should start tapering soon, hopefully this year

Patrick Harker, president and CEO of the Federal Reserve Bank of Philadelphia, in an interview with the Nikkei:

- I am supportive of moving toward a tapering process sooner rather than later. When exactly that happens, the committee needs to decide. I would hope sometime this year we would be able to start the tapering process.

Harker said it would be inappropriate for him to comment when asked about the FOMC making an announcement at the forthcoming meeting (September 20 & 21)

Old pic, JH was ‘virtual’ this year: