Archives of “September 7, 2021” day

rssUSDCAD moves above its 200 hour moving average for the first time since August 27

Buyer’s taking the pair higher today

The USDCAD has been stepping higher today, and in the process has been able to extend above overhead technical resistance levels.

The last break higher has taken the price above its 50% midpoint of the range since August 27 and the 200 hour moving average at 1.25933. The break above the 200 hour moving average is the first time since August 27.

Recall from last week, the price moved up to test that 200 hour moving average level (on Thursday) but found willing sellers.

With the move now above the 50% and moving average line, traders will now use those levels as a risk defining levels in the short term. Stay above is more bullish.

Target on the topside now include the recent swing highs starting with the high from last Thursday at 1.26382. The high from last Tuesday, and for the week, is at 1.26527. Above that and traders will start the eye the 1.2700 level. The high price from August 27 reached 1.27073 before rotating back to the downside.

Give Yourself TIME

US dollar extends further. It’s all about the ebb and flow today with a light calendar

Today is the first day without extra unemployment benefits in the US

The market is in the mood to buy US dollars as New York and Toronto return from long weekends. That’s weighing on commodity prices as well and adding a negative mood to markets.

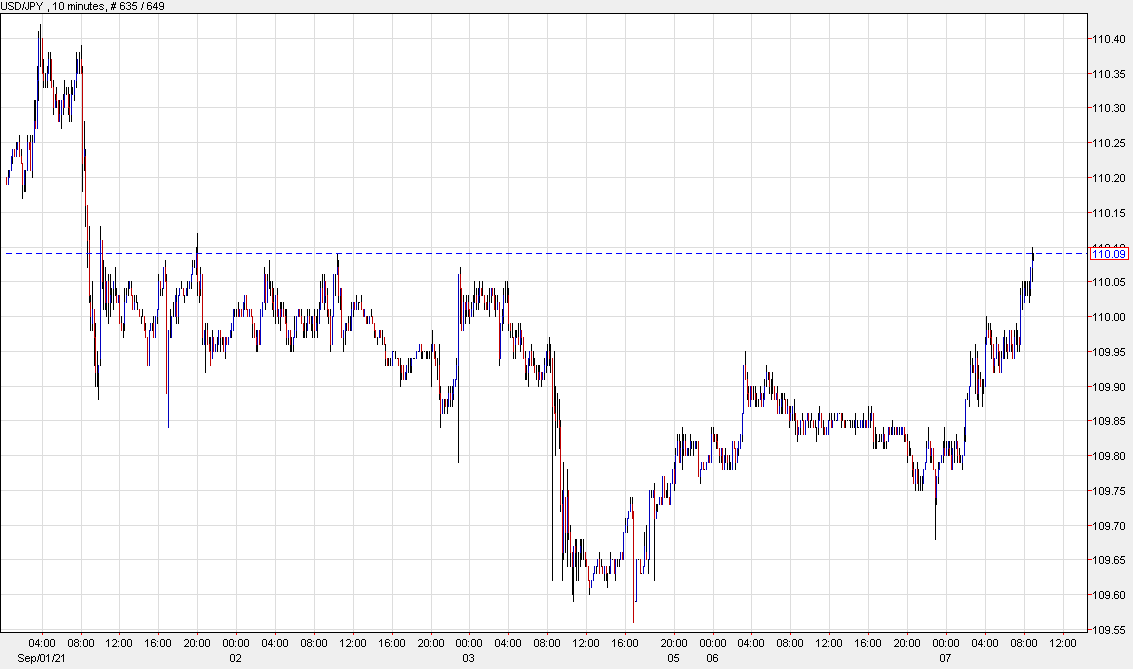

The dollar has extended to fresh highs against the euro and yen (shown above) in the past few minutes.

It will be all about the flows and technicals today with little scheduled news on the agenda. There’s no economic data today in the US or Canada. The lone notable event is a 3-year auction but sales that far up the curve rarely spill over into FX.

With that, it’s tough to find a reason to fade the dollar strength.

US 10-year yields threaten the top of the August range

Why are rates moving up on a soft jobs report?

The bond market is the driving force in markets today as the counter-intuitive selloff following non-farm payrolls is continuing. The August high of 1.379% is just over one basis point away after breaking through the 200-dma at 1.333%.

The thinking in the bond market is that the Fed had risked tightening prematurely and snuffing out both a recovery and inflation prematurely. The softer jobs print gives them a reason to wait and that might extend the timeline beyond when bottleneck-induced pricing starts to fade.

Adding to the upside is additional supply, with the Treasury selling $38 billion in 10-year notes tomorrow.

So far the rise in rates is lifting the US dollar as USD/JPY, GBP/USD and USD/CAD trade very close to session extremes.

Aside from the US-centric view, I’m beginning to wonder if worries about China and the ‘common prosperity’ plan are at work.

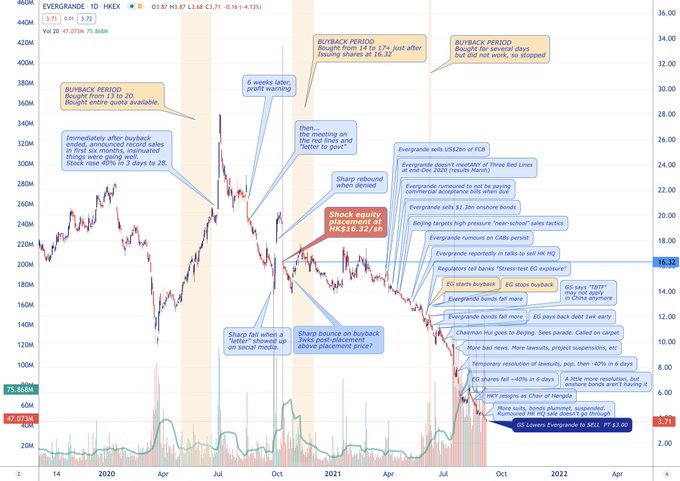

Evergrande ($3333) chart updated with important breaking news at bottom right.

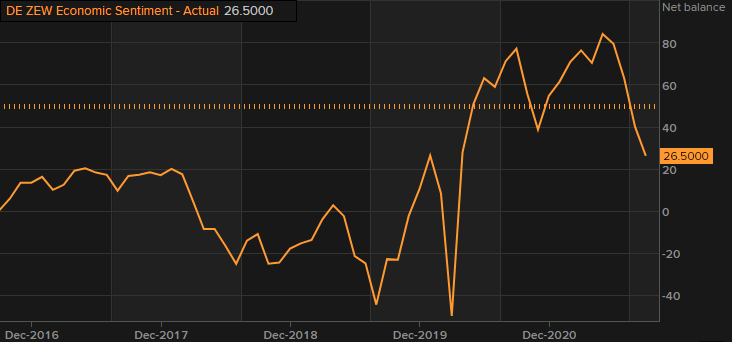

Germany September ZEW survey current conditions 31.9 vs 34.0 expected

Latest data released by ZEW – 7 September 2021

- Prior 29.3

- Outlook 26.5 vs 30.0 expected

- Prior 40.4

While there is an improvement to current conditions, the continued fall in the outlook is perhaps the more pertinent tell of economic sentiment at the moment. It reaffirms waning confidence as the summer ends and that growth expectations have peaked.

Amid delta variant concerns and supply chain disruptions, the fear now is that the anticipated slowdown in Q4 will be more severe than expected.

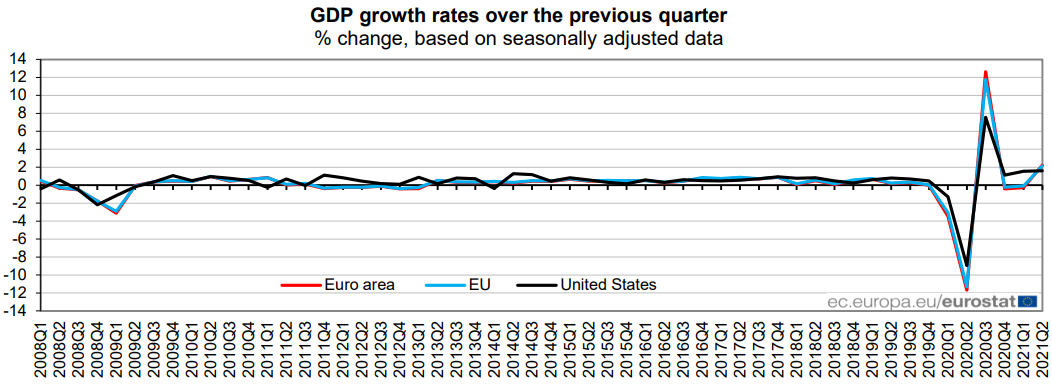

Eurozone Q2 final GDP +2.2% vs +2.0% q/q second estimate

Latest data released by Eurostat – 7 September 2021

- GDP +14.3% vs +13.6% y/y second estimate

The second estimate report can be found here. A slight bump in the final readings but nothing to add to the modest rebound in Q2 as virus restrictions were eased.

Treasury yields pull higher after the long weekend

10-year Treasury yields seen up at around 1.36% today

Yields are nearing the double-top just below 1.38% and that is the key technical region to watch as we get things going on the week.

The overall mood in the market has been a quiet one but keep an eye on bonds in case it kicks some life into things as traders stick with the post-NFP narrative.

The move in Treasuries is a bit convoluted given the US jobs report miss but one can argue that the easing of Fed taper expectations could see more durable/lasting inflation be achieved or the simpler explanation being that we have huge supply coming this week.

Either way, the technicals are still the key element to watch in the bond market right now but for the dollar, higher yields aren’t necessarily a comfort factor for now.