Latest data released by Eurostat – 29 July 2021

- Economic confidence 119.0 vs 118.5 expected

- Prior 117.9

- Services confidence 19.3 vs 19.9 expected

- Prior 17.9

- Industrial confidence 14.6 vs 13.0 expected

- Prior 12.7

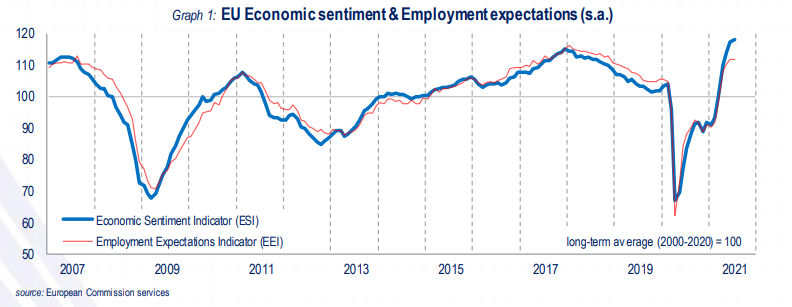

Euro area economic confidence reaches an all-time high as the upbeat mood is helped by the summer optimism. That said, the increase is a shallow one which could suggest that the indicator is nearing its peak for the time being.

Industrial confidence also increased for an eighth consecutive month, recording its own all-time high, while services confidence is seen picking up for a sixth straight month as it touches its highest level since August 2007.