US dollar drifts lower

The early risk aversion has turned into a quieter trade. US 10-year yields are up 2.6 bps to 1.2560% and the dollar has fallen around 25 pips across the board from the extremes of 2 hours ago.

I think higher long-end yields are the result of dovish Fed expectations and that also fits in with the higher dollar. The thinking is that the only way the Fed can push inflation up is with ultra-low rates. If they hike prematurely, it will mean rates/inflation will be stuck to the bottom for another cycle.

Overall, the market is quiet and I’m not sure that changes after the Fed. I think the only thing that matters is if Powell repeats that a taper is “still a ways off”.

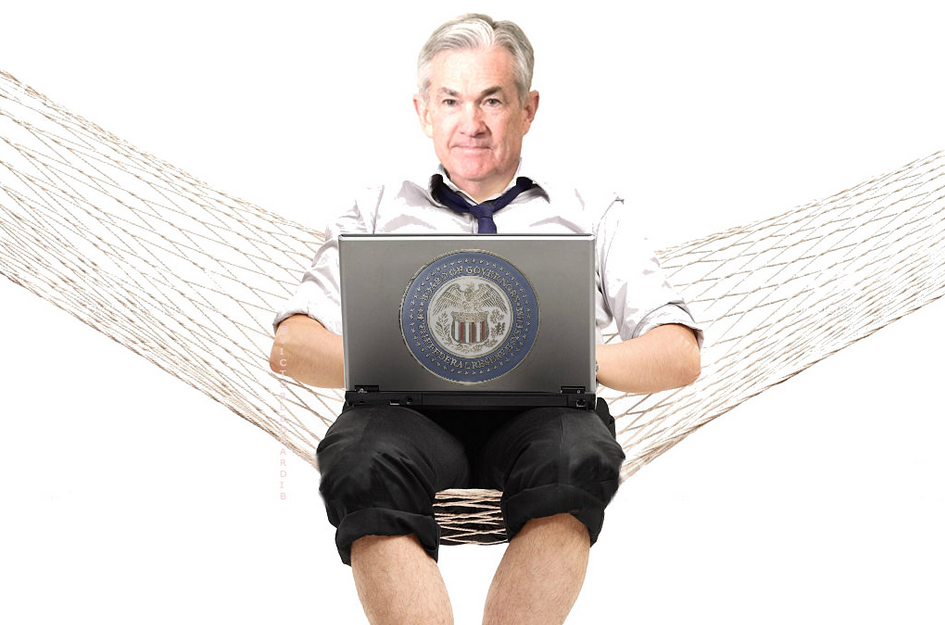

In the meantime, here’s a fun Fed preview from Compound Advisors:

BREAKING: FED HOLDS INTEREST RATES AT 0% AND PROMISES TO KEEP CREATING MONEY OUT OF THIN AIR TO BUY $120 BILLION IN BONDS PER MONTH. POWELL SAYS A) THERE’S NO INFLATION BUT EVEN IF THERE WAS IT WOULD BE “TRANSITORY” AND B) THERE ARE NO ASSET BUBBLES BUT EVEN IF THERE WERE THE FED’S EASY MONEY POLICIES WOULD HAVE NOTHING TO DO WITH THEM.