“Researches” are saying

It’s all quite deceptive, really – I mean, they are called the markets, after all, and things are bought and sold there and not much else happens at all. So how can the markets not be about price, when price is all there is?

Here is my solution. The stock market is not the place for bargain hunting. It’s not a shop that has discounts. It’s not about value at all – it’s about price movement. It’s all in the moves. The trick is to discover just how you want the price action to look before you take the plunge and risk your cash.

This is by no means an easy thing to do. It can be extremely hard to buy a share that has just risen 30% from its lows, because we automatically tell ourselves that we missed a bargain. However, it’s vitally important to hear what that kind of price action is telling us. To me, that share is hollering that something very cool is going on. People are buying it – in fact way more people are buying it than selling it. And if there are more buyers than sellers, it’s gonna go up.

Now that is simple.

The major European indices are ending the day with declines. Global stocks have moved mostly lower with China getting hammered overnight once again. The NASDAQ index is sharply lower as well with declines close to 2% ahead of big tech earnings after the close including Alphabet, Apple, and Microsoft.

Reversing a decision made just two months ago, the Centers for Disease Control and Prevention is expected to recommend on Tuesday that people vaccinated for the coronavirus resume wearing masks indoors under certain circumstances.

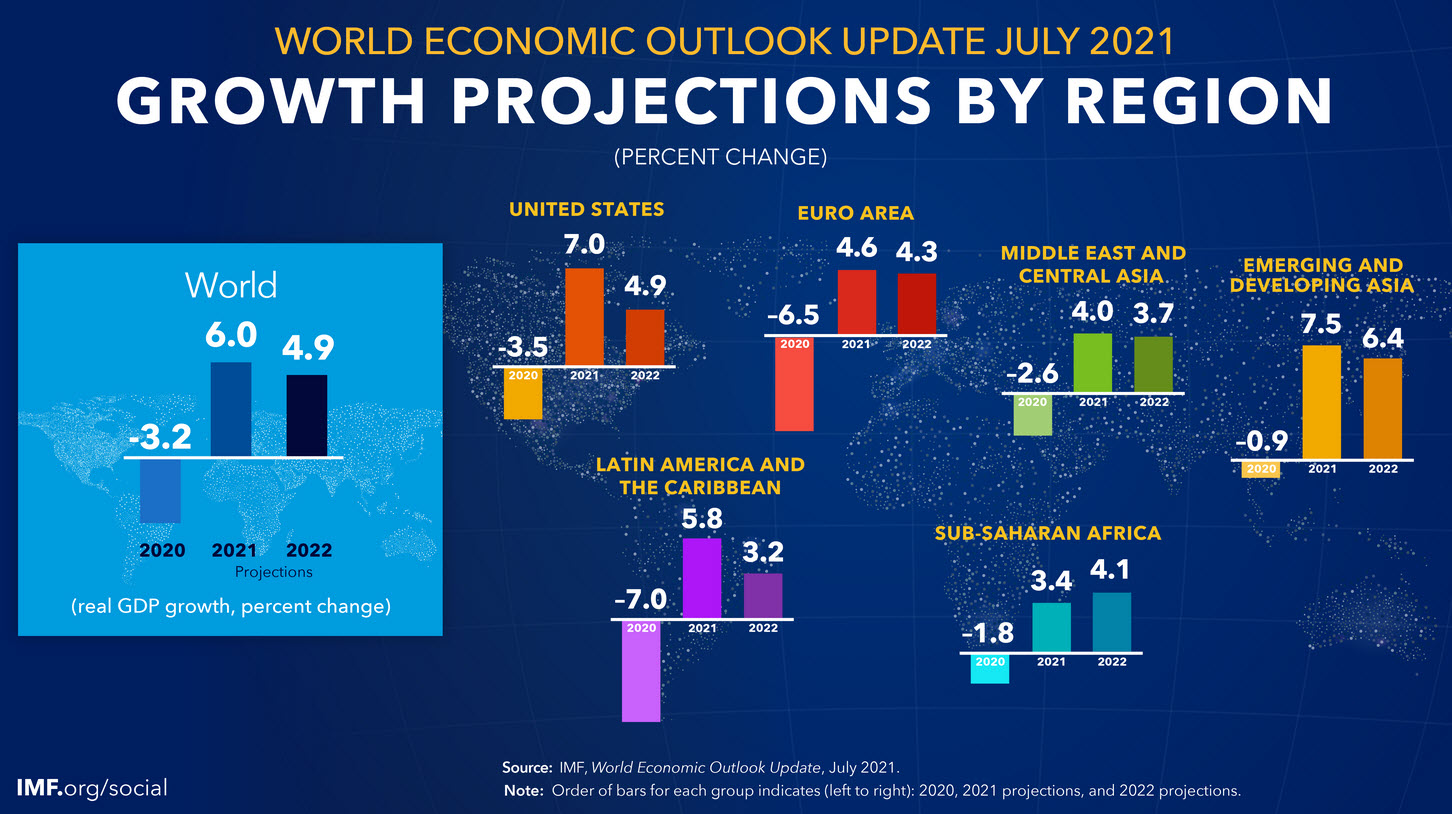

Despite a recent uptick in wage growth in the United States, wages of individuals-observed 12 months apart in the Atlanta Federal Reserve’s Wage Growth Tracker-do not indicate broader pressure in the labor market. Data from Canada, Spain, and the United Kingdom show similar patterns of broadly stable wage growth this year

And, finally, adding this snippet from UBS, a real quick one.

We expect little news from the Fed this week:

UBS add that implied pricing in the options market for the meeting is roughly in line with the past 12 meetings … that is a SPX move of +/-0.9%.

No dots at this meeting 🙁

Other highlights:

On Wednesday, Boeing, Ford, McDonalds, Facebook are some of the companies reporting.

Finally, on Thursday Amazon, Merch, Mastercard earnings will be released.