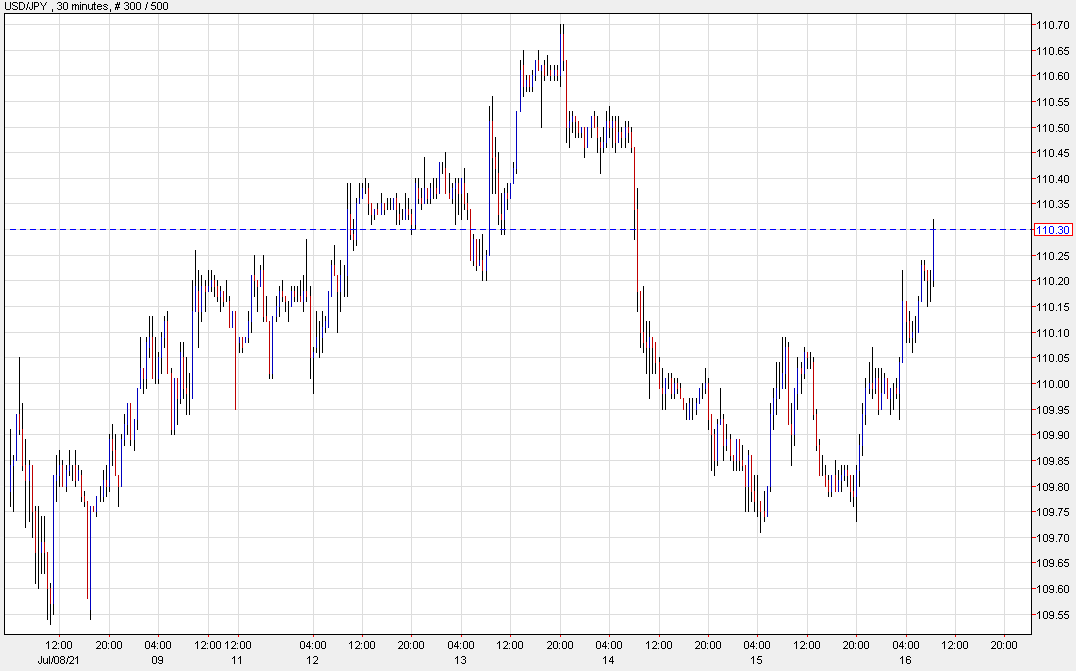

USD/JPY chews into the drop

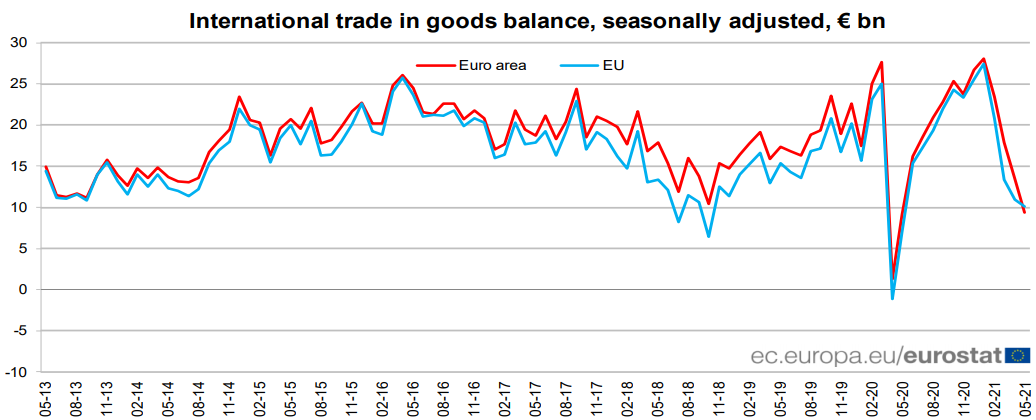

Seasonally adjusted exports were seen down 1.5% m/m while imports grew by 0.7% m/m, seeing the trade surplus shrink in May compared to April. The adjustment process continues as trade conditions are still normalising since the pandemic.

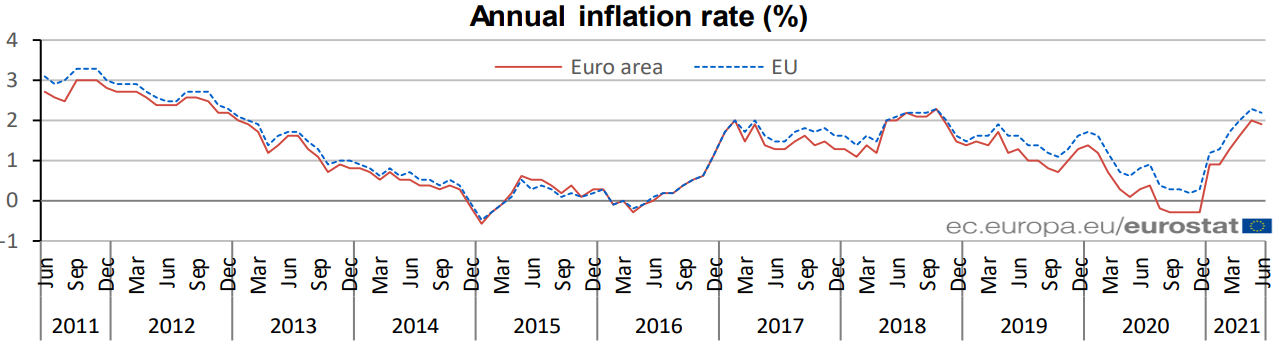

The preliminary report can be found here. No change to the initial estimates as core inflation keeps just under 1% so that might give the ECB some breathing room in pushing back against the latest rise in inflation, though the headline is nearing 2%.

Never be too proud that you are unwilling to point out your flaws. In this article, you will see a number of examples where I have called out flaws in my trading. This is both therapeutic and also forces me to realize that my issues have little to do with my system and more around how I mentally approach the market.

If you approach the market from a negative perspective, you will lose money. Negative does not mean you expect to lose, but you may have a lot of fear in your trading or have not fully accepted the risk. Reviewing your equity curve and keeping a trading journal will help you navigate times when you fall off the rails.

Recognizing when you are wrong does not mean the stock deviated from how your analysis stated things should go. Remember, the market is completely random. Understanding when you are wrong is something you need to define. For me, it’s how much a position goes against me before I see a profit. Once this happens things will go one of two ways for me. First, the market will give me the mercy exit opportunity and will close the position with a minor loss or slight gain. Secondly, the market will continue in the opposite direction and I will take a bath. Please do not get caught up in my specific rules; more focus on the fact that you need to know when you are wrong. Accepting that you will not always get it right will save you all sorts of time and money.

More importantly, you will begin to think of the market in terms of averages. You will have x percentage of winners and x percentage of losers. There is no escaping this fact. Show me a trader that always needs to be right and I will show you a negative equity curve.

Keeps monetary policy steady

Core CPI forecasts ahead:

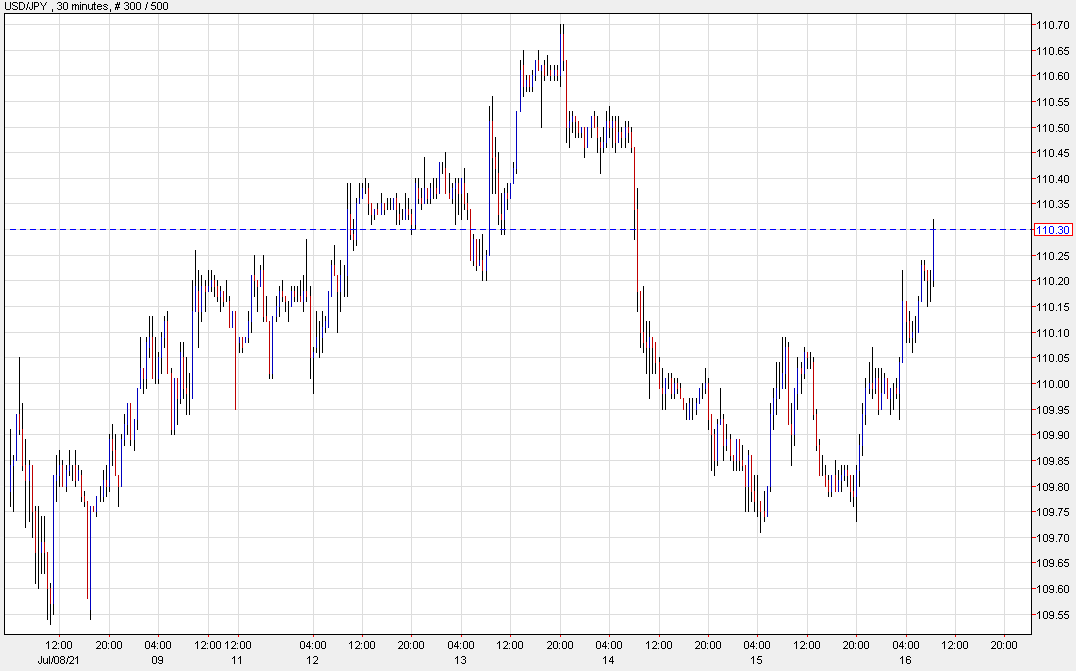

In the immediate aftermath of the statement and report USD/JPY is barely changed:

Some of you reading this will say that you always place your stop and are willing to lose the money. While you may say this, you really don’t want to lose the money. You’ll place your stop out there, which could be pretty far off from your entry price. Over the next couple of hours or days depending on your timeframe, you will slowly move the stop up because the stock is not “acting” properly. Sure enough, at some point, your new stop order is triggered right before the market takes off. If this has happened to you, it is one of the most frustrating events that can occur in the market. Your analysis was right, the market, in the end, gave you what you expected; however, you were not willing to accept the randomness of the market and the fact you could lose money.

Some of you reading this will say that you always place your stop and are willing to lose the money. While you may say this, you really don’t want to lose the money. You’ll place your stop out there, which could be pretty far off from your entry price. Over the next couple of hours or days depending on your timeframe, you will slowly move the stop up because the stock is not “acting” properly. Sure enough, at some point, your new stop order is triggered right before the market takes off. If this has happened to you, it is one of the most frustrating events that can occur in the market. Your analysis was right, the market, in the end, gave you what you expected; however, you were not willing to accept the randomness of the market and the fact you could lose money.

PBOC injects 10bn yuan via 7-day reverse repos