Archives of “July 9, 2021” day

rss“Trading in the Zone” by Mark Douglas

A Lithuanian Olympics athlete reportedly tested positive for COVID-19 in Tokyo

And so it begins

A Lithuanian athlete is reported to have tested positive for COVID-19 in the Japanese capital, with reports also leaking that a member of Israel’s Olympics team has also tested positive upon arrival in Tokyo for the games.

With Tokyo undergoing a state of emergency, the Olympics will take place without spectators but it is regrettable to see that athletes are contracting the virus as well; even if it may have been due to the travel journey itself.

The Olympics will take place starting from 23 July and this arguably won’t be the last cases we hear involving athletes/teams contracting the virus.

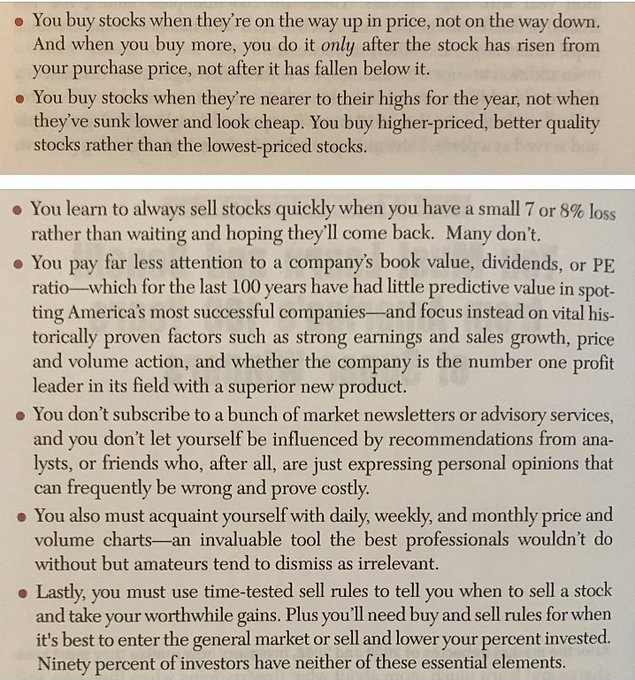

Key points of O’Neil’s system that made him one of the best. From his classic book HTMMIS.

10-year Treasury yields bouncing back ahead of European trading

Is the great short squeeze over?

10-year yields are back up above 1.30%, coming well off yesterday’s low of 1.25% as we see a move towards 1.34% ahead of European trading today.

There was a late bounce yesterday already as equities also fade losses but there is still some hint of caution considering the developments seen earlier in the week.

It it still too early to say what the latest bounce represents but so far, market participants may take some comfort from this ahead of the weekend at least.

G20 Finance Ministers and Central Bank Governors’ meeting begins in Italy Friday 9 July 2021

Today and Saturday the G20 Finance Ministers and Central Bank Governors meet in Venice.

This will be the first in-person Finance Track meeting since February 2020

Discussions will be held on

- the international economy and global health

- efforts towards economic recovery

- promoting more sustainable growth

and more.

What are described as “side events” include:

- Global Forum on Productivity

- G20 High-Level Tax Symposium

- Climate

There will be headlines from this, all the talking heads are attending.

You’ll be surprised how fast oil will move once a solid weekly close above 74$-75$. 100$ Q4. Got inflation? Got silver? Got gold?

Central banks continued to purchase gold in May with net purchases of 57t, driven mainly by Thailand and Brazil

Germany house prices up 75% vs. rents up by 15%. Bubble?

The BOJ meet next week – likely to lower GDP forecast

The Bank of Japan meet July 15 and 16. Thursday and Friday next week.

The policy statement and the Bank’s latest updated forecasts (in its Outlook Report) will be made Friday at the conclusion of the meeting (there is no firmly set time for the announcement, sometime between 0230 and 0330 GMT on Friday is a good bet).

Reports are the Bank is expected to slash this fiscal year’s growth forecast in its latest projections.

Earlier this week the Japan Center for Economic Research said its assessment was Japan’s gross domestic product dipped 0.04% on the month in May (using inflation adjusted data … albeit not much inflation in Japan!).

- the second straight monthly decline, though marginal

- Consumption -0.7%

- Housing investment -1.1%

- capital investment by private companies +0.6%

- Exports -0.2%, imports -2.6%

- reduced production in manufacturing such as automobiles

- “Due to a shortage of semiconductors, passenger vehicle production may have begun to deteriorate”

Earlier this week there was mixed news, BOJ maintains assessment for 5 of 9 Japanese regions in latest economic report:

- two upgrades & two downgrades

In other news, Tokyo will be in a state of emergency right through its Olympics. The city has been dealt an awful hand with these Games and is making the very best of it in the circumstances.