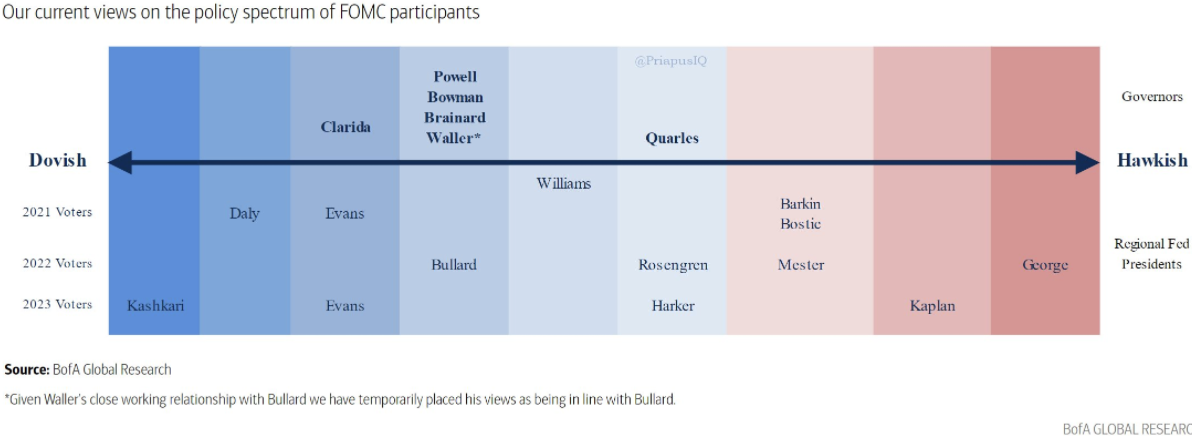

Given the policy stance of the Federal Open Market Committee they all doves.

Its just that some are more dovish than others. That’s my read.

This, though, is the read from Bank of America:

Its quite handy given it outlines who will be voting in the years ahead too. Note the ‘Governors’ (listed above the arrow) always vote, as does NY Fed Presid