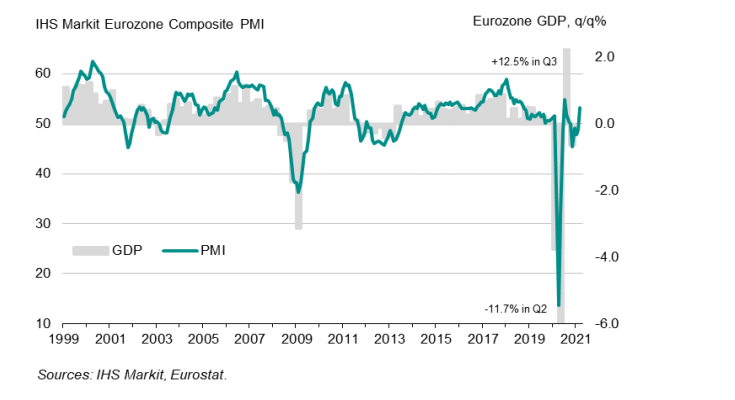

Latest data released by Markit – 7 April 2021

- Composite PMI 53.2 vs 52.5 prelim

“Eurozone business activity bounced back in March, returning to growth after four months of decline with an even stronger expansion than signaled by the forecast-beating ‘flash’ data.

“Manufacturing is booming, led by surging production in Germany, and the hard-hit service sector has come close to stabilizing as optimism about the outlook improved further during the month. Firms’ expectations of growth are running at the highest for just over three years amid growing hopes that the vaccine roll-out will boost sales in the coming months.

“Strengthening demand has already led to the largest rise in backlogs of uncompleted work seen for almost three years, encouraging increasing numbers of firms to take on additional staff. Improving labour markets trends should help further lift consumer confidence and spending as we head into the second quarter.

“The survey therefore indicates that the economy has weathered recent lockdowns far better than many had expected, thanks to resurgent manufacturing growth and signs that social distancing and mobility restrictions are having far less of an impact on service sector businesses than seen this time last year. This resilience suggests not only that companies and their customers are looking ahead to better times, but have also increasingly adapted to life with the virus.”