The missile was launched from neighbouring Syria, fired into southern Israel early on Thursday.

- Air raid sirens were sounded near Israel’s nuclear reactor near Dimona

- Israeli military attacked the missile launcher and air-defence systems in Syria.

- There is widespread speculation of likely Iranian involvement, which will be a complication in US-Iran talks seeking to revive the nuclear deal with Iran.

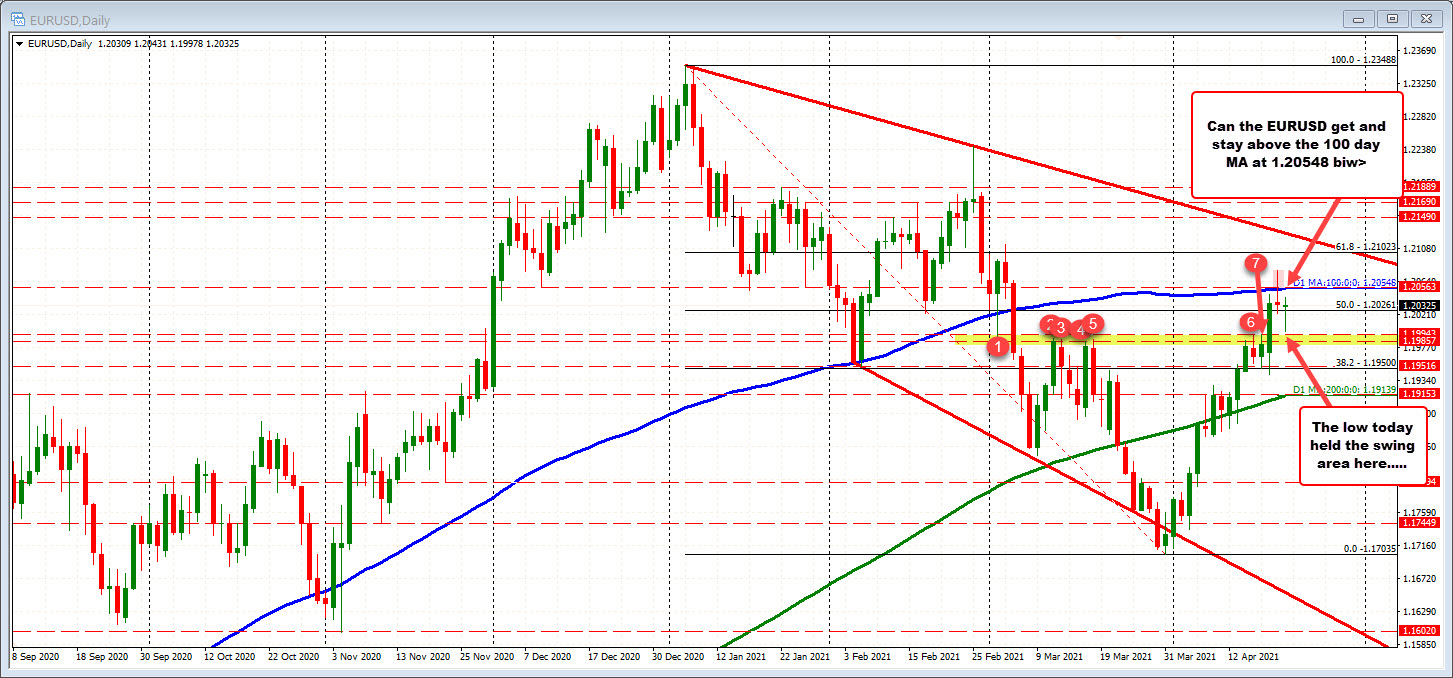

Oil is little changed on the session here.