Archives of “April 22, 2021” day

rssECB leaves key rates unchanged in April monetary policy meeting, as expected

ECB announces their latest monetary policy decision – 22 April 2021

- Prior decision

- Deposit facility rate -0.50%

- Main refinancing rate 0.00%

- Marginal lending facility 0.25%

- PEPP purchases over the current quarter to continue to be significantly higher

- Reaffirms size of PEPP program at €1.85 trillion

- PEPP purchases to be conducted flexibly according to market conditions

- QE purchases will continue at monthly pace of €20 billion

- ECB stands ready to adjust all of its instruments, as appropriate

- Full statement

They are reaffirming their pledge of higher PEPP purchases until June but so far it hasn’t really been showing up in the data, at least not “significantly”. Other than that, the rest of the policy language appears to be unchanged. The ECB still retains the key passage:

The Governing Council expects the key ECB interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.

Pretty much a non-event as they continue to maintain that PEPP is flexible with regards to timing and size, in that they don’t have to use the full envelope or can increase it.

Over to Lagarde next but barring any communication mishap, there shouldn’t be much for euro traders to chew on. As such, the technicals are still the key thing to watch.

Eurostoxx futures +0.6% in early European trading

Positive tones observed in early trades

- German DAX futures +0.5%

- UK FTSE futures +0.5%

This builds on the gains from yesterday, as European equities are still clawing back the deep losses sustained on Tuesday. The more positive mood here also in part reflects some catch up to the surge in US equities – which closed at the highs.

US futures are looking rather flattish so far to start the session, while Treasury yields are a touch lower with 10-year yields down 2 bps to 1.535%.

Nikkei 225 closes higher by 2.38% at 29,188.17

A solid rebound for Japanese stocks

The Topix also climbs 1.8% on the day amid the surge in US equities overnight and the BOJ stepping in for the first time this month with ETF purchases yesterday.

The bounce here sees both the Nikkei and Topix move off its 100-day moving average to keep above the key technical level for the time being.

Elsewhere in the region, the Hang Seng is up 0.6% while the Shanghai Composite is down 0.3% in a bit more of a mixed mood. US futures are flattish as we look to get into European morning trade.

ICYMI – a missile struck near Israeli nuclear reactor

The missile was launched from neighbouring Syria, fired into southern Israel early on Thursday.

- Air raid sirens were sounded near Israel’s nuclear reactor near Dimona

- Israeli military attacked the missile launcher and air-defence systems in Syria.

- There is widespread speculation of likely Iranian involvement, which will be a complication in US-Iran talks seeking to revive the nuclear deal with Iran.

Oil is little changed on the session here.

European Central Bank policy meeting Thursday 22 April 2021 – preview

Westpac with a quick take on what to expect from the ECB meeting today:

- The Council will restate their commitment to accommodative conditions and will acknowledge that any imminent lift in inflation will be temporary (and be treated accordingly in a policy context).

- There will be some cause for cautious optimism around the coming quarters, despite extended lockdowns delaying the reopening rebound. April consumer confidence will continue to be constrained by the lockdowns and slow vaccine rollout (market f/c: -11).

Via NAB:

- meeting should be uncontroversial with no change in policy settings, no new forecasts, all against a rather benign market background.

- The question will be, is this a meeting where the overall message is the ECB is sufficiently encouraged by the outlook to allow markets to think an upgrade is coming in June, or will developments such as the Euro bounce (itself a sign of a global recovery) and the limited progress in the Recovery Fund, ensure the ECB toes an ongoing cautious line?

—

ECB announcement due at 1145GMT

US economy forecast to grow at its fastest in nearly 40 years

Via a Reuters survey of analysts (April 16-20 poll of over 100 economists):

The U.S. economy predicted to grow on average 6.2% this year

- if so this would be the fastest annual expansion since 1984

- about 15% of 105 economists predicted the economy would grow 7% or more

Nearly 70% of economists (39 of 56) in response to an additional question said the biggest risk to the economy was a resurgence in coronavirus cases over the next three months.

Comments from BMO:

- “We raised our growth forecast due to additional fiscal stimulus and the speedy vaccination program”

- ” “The upshot is that the U.S. economy is smoking. But another wave of cases would put our forecast at risk. For now, we assume it won’t lead to another round of aggressive restrictions.”

TD are wary of expecting such growth to continue next year:

- “As we will get later in the year and certainly in 2022, the boost from not just reopening but also fiscal stimulus will be fading to the point when the stimulus turns into a fiscal drag”

- “So there are a lot of reasons to not simply extrapolate the strong numbers we are seeing now and we expect the net result at the end to be less than a complete recovery in the labor market.”

—

The consensus view seems to be ‘transitory’ rapid growth (and inflatio

WSJ reports that Credit Suisse’s exposure to Archegos grew to over $20bn

Via a WSJ piece, citing people familiar with the matter.

- Credit Suisse Group amassed more than $20 billion of exposure to investments related to Archegos Capital Management

- the bank struggled to monitor them before the fund was forced to liquidate many of its large positions .. parts of the investment bank hadn’t fully implemented systems to keep pace with Archegos’s fast growth, the people said.

Link here (may be gated)

Coronavirus – J&J vaccine Phase 3 trial published today

In the New England Journal of Medicine, article link here: Ad26.COV2.S Vaccine Efficacy against Covid-19

The summary of the piece:

- In a randomized trial involving nearly 40,000 persons, vaccine efficacy was 66% against infection and 85% against severe-critical Covid-19. Efficacy against the variant first identified in South Africa was 64% against moderate disease and 82% against severe-critical disease.

Check out that link above for more.

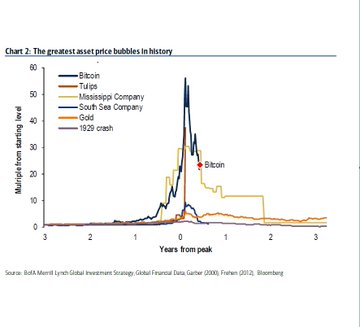

EURUSD rebounds back above 50% retracement

50% midpoint of the 2021 range comes in at 1.20261

The EURUSD rejected the break above the 100 day MA yesterday and today moved back below the 50% midpoint of the 2021 trading range at 1.20261.

However, the selling found buyers just ahead of a swing area between 1.19857 to 1.19943. The low today reached 1.19978. The move back higher, has pushed the price back above the 50% midpoint level (at 1.20261). That is a tilt more to the upside.

Focus to the upside will once again be centered on the 100 day MA at 1.20548. Get above that and stay above, is the next key upside hurdle.