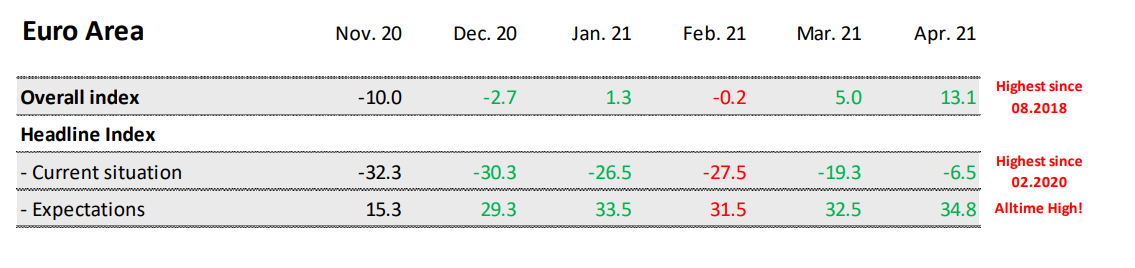

Latest data released by Sentix – 6 April 2021

- Prior 5.0

A solid beat in the headline reading, jumping to its highest since August 2018. This reaffirms the more upbeat mood surrounding economic expectations moving forward.

We’ll see how the vaccine rollout progresses in the coming months though to be sure but a Bloomberg report just out says that the EU is projecting near-virus immunity by the end of June, superseding its initial target estimate by the summer (end July).