The recovery from last week’s rout continues

The major European indices are enjoying their 2nd consecutive up day and clawing back losses from last week. The German DAX fell -8.6% last week. Italy’s FTSE MIB fell by around -7%. France’s CAC and Spain’s Ibex fell by -6.4% in the UK FTSE fell by about -5%. It was ugly.

Lower this week has seen a nice rebound. The provisional closes are showing:

- German DAX, +2.5%

- France’s CAC, +2.4%

- UK’s FTSE 100, +2.2%

- Spain’s Ibex, +2.6%

- Italy’s FTSE MIB, +3.0%

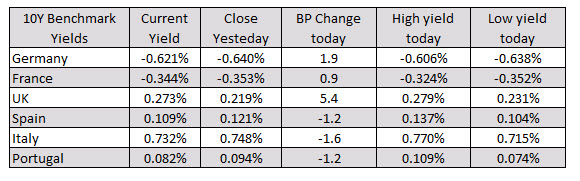

in the European debt market, the benchmark 10 year yields are mixed with investors pushing into the more risk year countries including Spain, Italy, and Portugal (rates are lower in those countries), while selling Germany, France and the UK (rates are higher in those countries).

In other markets as London/European traders exit for the day.

In other markets as London/European traders exit for the day.US stocks throwing caution to the wind ahead of the election:

- S&P index is up 78 points or 2.36% 3388.30

- NASDAQ index is up 244 points or 2.23% at 11200

- Dow industrial average is up 680 points or 2.5% at 27603

In the US debt market, yields are higher with the yield curve steepening. The 2 – 10 year spread is up to 71.88 basis points from 68.89 basis points at the close yesterday: