Archives of “August 2020” month

rssRetail outperforming hedge funds 38:1 YTD

“My portfolio is in the United States of America.” André Kostolany

European Indices end the session higher

Back into the black after the declines yesterday

The European shares are ending the session higher. The laggard is the UK FTSE 100 which rose by a scant +0.1%. The gains were also varied with the German DAX leading the way at +1.0%. Shares move higher on Monday but gave back some of the gains on Tuesday.

The provisional closes are showing:

- German DAX rose 1.0%. The low for the day reach -0.39%

- France’s CAC rose 0.8%. The low for the day reached -0.61%

- UK’s FTSE 100 rose 0.1%. The low for the day reach -0.74%

- Spain’s Ibex rose 0.24%. The low for the day reached -0.53%

- Italy’s FTSE MIB rose 0.24%. The low for the day reached -0.51%

In other markets as London/European traders look to exit:

- Spot gold is trading up $16 or 0.82% at $1944. It is trading just off the high price for the day at $1945.98. The low price extended to $1902.89.

- Spot silver is also higher. It is trading up $0.58 orders 2.2% at $27.12. That is just off the high price of $27.15

- WTI crude oil futures are higher by $0.08 at $43.43. Hurricane Laura is bearing down on the Louisiana/Texas border. Inventory data showed a larger than expected drawdown but in line with the API data from last night. The high price reached $43.78. The low price has bottomed at $43. The price is above its 200 day moving average at $43.25 today.

From an Advanced IBD session years ago – no need to spread out all over the place. Best traders concentrated their portfolios.

This happened next

Make sure that you internalize and never violate any of these rules and thus avoid crappy #stocks right from the beginning.

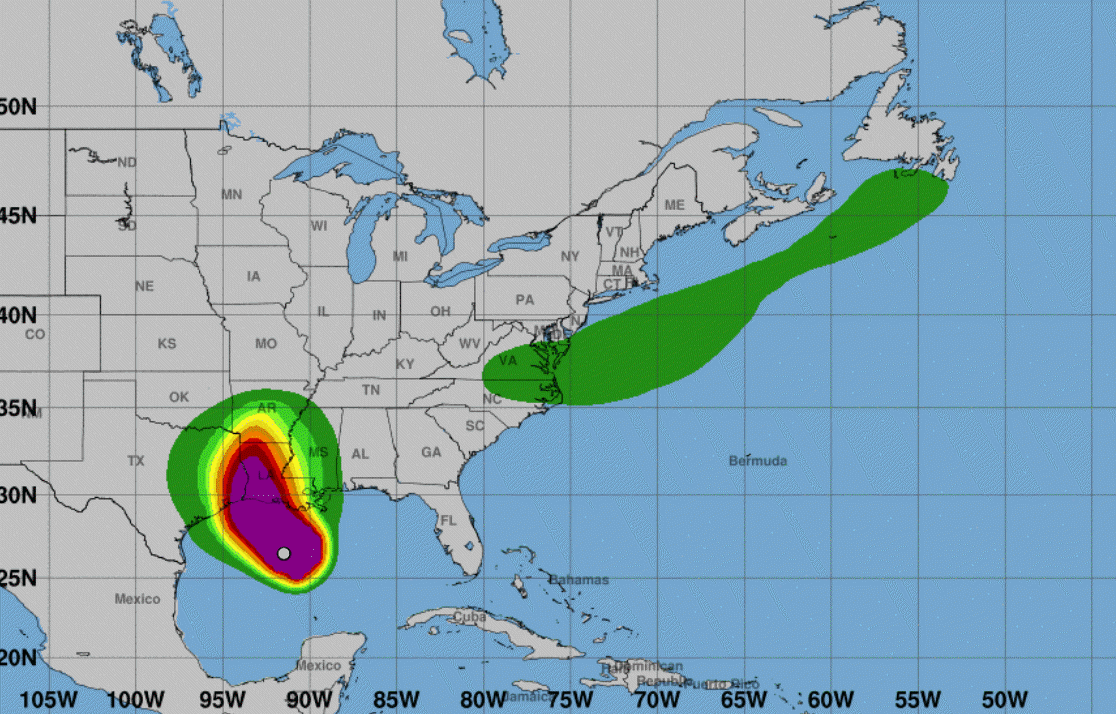

Laura expected to make landfall in about 12 hours as Category 4 hurricane

The latest from the NHC forecast

The US National Hurricane Center is out with its latest update on Hurricane Laura and it’s not good.

Laura is likely to continue strengthening today while it moves over warm waters of the northwestern Gulf of Mexico and the vertical wind shear remains low. Laura’s intensity could level-off by this evening due to the possibility of an eyewall replacement cycle and the expected increase in shear around the time of landfall. Even if the rate of strengthening eases, Laura is expected to be an extremely powerful category 4 hurricane when it reaches the northwestern Gulf coast.

This has the potential to be especially devastating for the oil & gas industry and its workers. The current track takes the eye through or near Beaumont, TX or Lake Charles, LA. Both are massive US refining hubs. The Houston area will also be hit but it now looks like the worst of the storm will pass to the east of it.

Category 4 hurricanes have sustained winds in the 209-251 km/h range, or 130-156 mph. Storm surges are generally 13-18 feet but can be as much as 24 feet. The NHC says the storm surge from Laura could penetrate 30 miles inland.

A recent Category 4 storm was Hurricane Harvey in 2017. It inflicted an estimated $125B in damage as it first made landfall near Corpus Christi and then raked the coast, causing widespread flooding in Houston. It matched Katrina as the most-costly US hurricane.

This storm appears to be faster moving so flood damage may not be as high but wind damage could be worse. It will also then cut across the mid-Atlantic states and could reform as a tropical storm off the coast of North Carolina or Virginia.

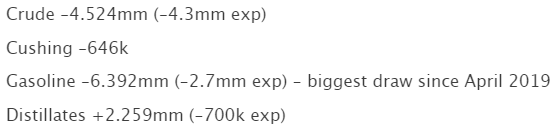

US crude oil inventories -4.689M vs. -2.587M estimate

DOE crude inventory data for the current week of August 21, 2020

- WTI crude oil futures traded at $43.59 just before the release

- crude oil inventories -4.689M vs. -2.587M estimate

- gasoline inventories -4.583M vs -1.750M estimate

- distillates +1.388M vs -0.050M estimate

- Cushing -0.279M vs -0.607M last week

- crude oil implied demand 17386 vs. 16663 last week

- gasoline demand 9780.4 vs. 9437.9 last week

- distillates demand 5052.7 vs. 4768.3 last week

The private data released new the close yesterday showed crude inventories -4.524M and gasoline -6.392M. The crude oil data was close to the API data.

The price of crude oil is currently trading at $43.62. That is only $0.03 higher than the pre-release levels. The high price reached $43.78 today while the low price stalled at $43. Technically, the price has moved further above its 200 day moving average at $43.25. Yesterday that moving average was broken for the 1st time since February 20. Staying above the moving average would be more bullish.

Below are the private data from the API released near the close of day yesterday

China launched to mid missiles into the South China Sea on Wednesday morning: Source

A source close to the Chinese military

According to a source close to the Chinese military, China launched 2 missiles into the South China Sea on Wednesday morning. The launch was to send a warning to the United States.

According to the source, the missile launch was intended to deny other forces access to the disputed South China Sea region. Yesterday an American spy plane reportedly neared the Chinese naval drills in the sea.

The US has added 24 Chinese companies to an entity list. That will also impose a visa restrictions as a result of South China Sea tensions.