Archives of “August 26, 2020” day

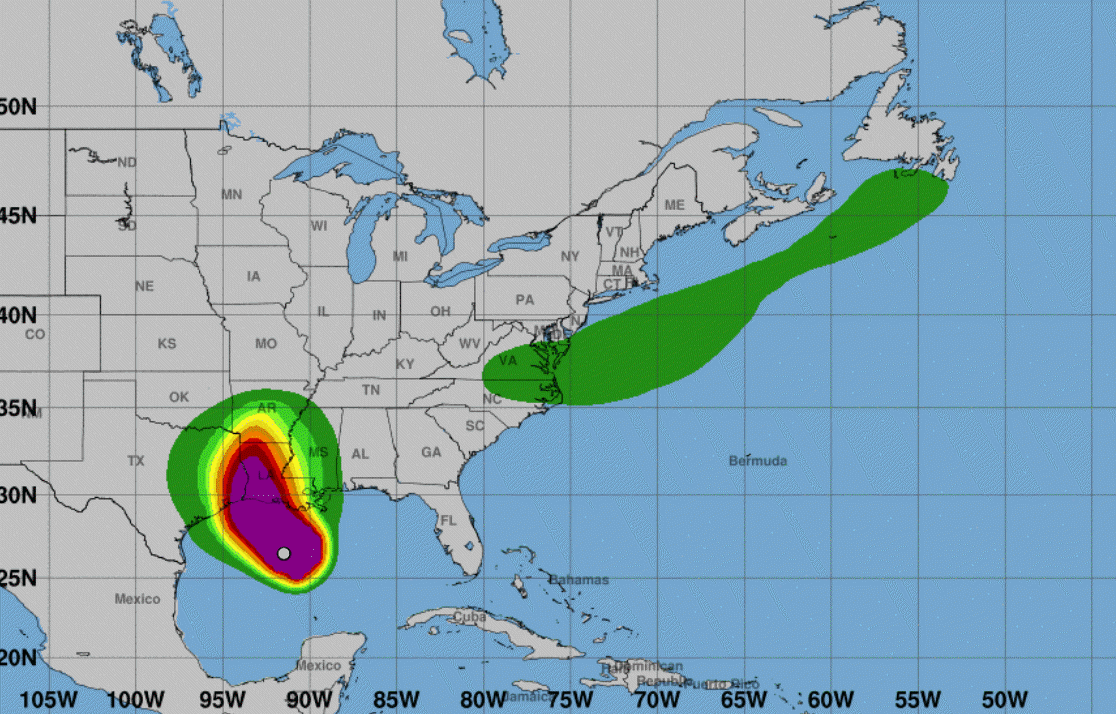

rssLaura expected to make landfall in about 12 hours as Category 4 hurricane

The latest from the NHC forecast

The US National Hurricane Center is out with its latest update on Hurricane Laura and it’s not good.

Laura is likely to continue strengthening today while it moves over warm waters of the northwestern Gulf of Mexico and the vertical wind shear remains low. Laura’s intensity could level-off by this evening due to the possibility of an eyewall replacement cycle and the expected increase in shear around the time of landfall. Even if the rate of strengthening eases, Laura is expected to be an extremely powerful category 4 hurricane when it reaches the northwestern Gulf coast.

This has the potential to be especially devastating for the oil & gas industry and its workers. The current track takes the eye through or near Beaumont, TX or Lake Charles, LA. Both are massive US refining hubs. The Houston area will also be hit but it now looks like the worst of the storm will pass to the east of it.

Category 4 hurricanes have sustained winds in the 209-251 km/h range, or 130-156 mph. Storm surges are generally 13-18 feet but can be as much as 24 feet. The NHC says the storm surge from Laura could penetrate 30 miles inland.

A recent Category 4 storm was Hurricane Harvey in 2017. It inflicted an estimated $125B in damage as it first made landfall near Corpus Christi and then raked the coast, causing widespread flooding in Houston. It matched Katrina as the most-costly US hurricane.

This storm appears to be faster moving so flood damage may not be as high but wind damage could be worse. It will also then cut across the mid-Atlantic states and could reform as a tropical storm off the coast of North Carolina or Virginia.

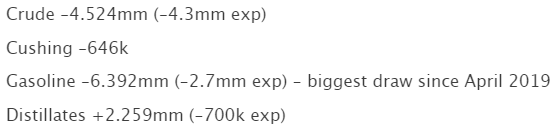

US crude oil inventories -4.689M vs. -2.587M estimate

DOE crude inventory data for the current week of August 21, 2020

- WTI crude oil futures traded at $43.59 just before the release

- crude oil inventories -4.689M vs. -2.587M estimate

- gasoline inventories -4.583M vs -1.750M estimate

- distillates +1.388M vs -0.050M estimate

- Cushing -0.279M vs -0.607M last week

- crude oil implied demand 17386 vs. 16663 last week

- gasoline demand 9780.4 vs. 9437.9 last week

- distillates demand 5052.7 vs. 4768.3 last week

The private data released new the close yesterday showed crude inventories -4.524M and gasoline -6.392M. The crude oil data was close to the API data.

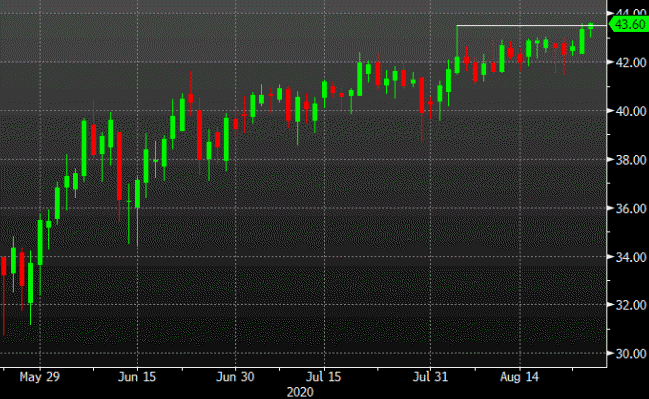

The price of crude oil is currently trading at $43.62. That is only $0.03 higher than the pre-release levels. The high price reached $43.78 today while the low price stalled at $43. Technically, the price has moved further above its 200 day moving average at $43.25. Yesterday that moving average was broken for the 1st time since February 20. Staying above the moving average would be more bullish.

Below are the private data from the API released near the close of day yesterday

China launched to mid missiles into the South China Sea on Wednesday morning: Source

A source close to the Chinese military

According to a source close to the Chinese military, China launched 2 missiles into the South China Sea on Wednesday morning. The launch was to send a warning to the United States.

According to the source, the missile launch was intended to deny other forces access to the disputed South China Sea region. Yesterday an American spy plane reportedly neared the Chinese naval drills in the sea.

The US has added 24 Chinese companies to an entity list. That will also impose a visa restrictions as a result of South China Sea tensions.

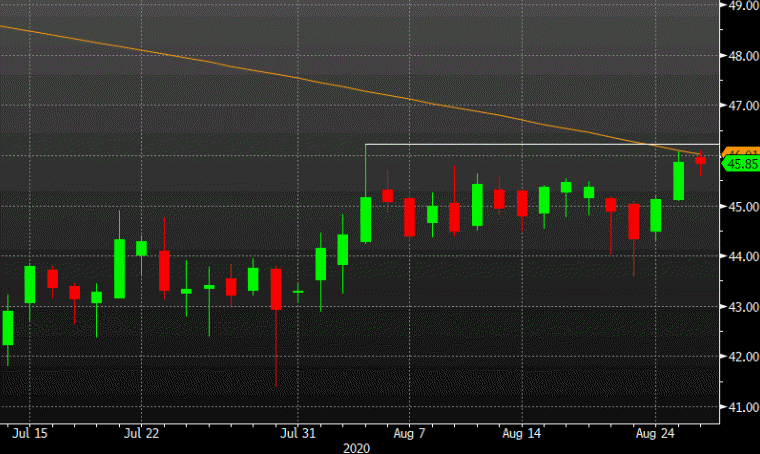

Oil climbs to post-pandemic high as Laura intensifies

WTI crude breaks the August high

WTI crude closed yesterday at a post-pandemic closing high but today it has also broken the intraday high. Crude was near a session low until the latest weather observations showed Hurricane Laura as a Category 3 storm and likely to intensify further. It’s headed for the heart of US offshore oil production and refining.

I’m skeptical of a storm-inspired breakout in oil because it’s not a fundamental change in the market. The chart to watch is Brent, as it also flirts with the August high and the 200-dma.

The next major update for Laura will be at 11 am ET. It’s expected to make landfall late tonight or early tomorrow.

China Margin Debt

Pimco-Bloomberg real-yield-adjusted price

France to unveil economic recovery plan on 3 September

As confirmed by French prime minister, Jean Castex

The original unveiling date for the proposed plan was for 25 August but that has been pushed back since the weekend, with the government now confirming that they will present details of the €100 billion plan on 3 September instead.

Castex also adds that local authorities would do all they can to avoid another lockdown in efforts to limit the spread of the virus, as fears are growing over a second wave of infections starting to hit the country over the past few weeks.

Nikkei 225 closes lower by 0.03% at 23,290.86

A tepid session for Asian equities today

Asian stocks are failing to take heart in the record-setting day for both the S&P 500 and Nasdaq yesterday, as the Nikkei closes near flat levels while the Hang Seng and Shanghai Composite are seen down by 0.1% and 1.3% respectively.

Equities are sort of taking a bit of a breather for now, though rising Treasury yields may be a bit of a concern as well. 10-year yields are now up by 3 bps to 0.714% on the day and are moving close to the 13 August high @ 0.725%.

The mixed risk tone is leaving little for major currencies to work with as ranges are keeping more narrow to start European morning trade. EUR/USD is a little lower at 1.1816 but still holding within a 32 pips range today.

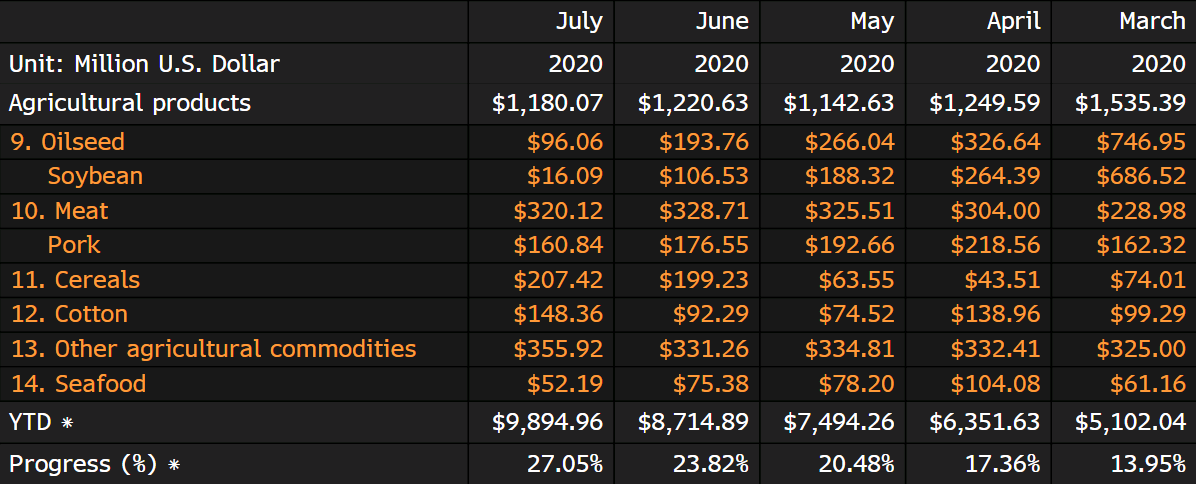

China reportedly said to expect record amount of US soybean purchases this year

Bloomberg reports, citing people familiar with the matter

The report says that China is said to expect a record amount of US soybean purchases this year as “lower prices help to boost purchases pledged under the Phase One trade deal”.

Adding that the total imports from the US will probably reach about 40 million tonnes in 2020, which will be around 25% more than the 2017 level – the baseline year for the deal.

That said, one of the sources did provide a caveat in saying that despite the forecast and expectation, China’s imports will ultimately be decided by soybean prices and the impact of the virus pandemic i.e. no firm commitment.

I don’t think the report here is a coincidence after customs data yesterday showed that Chinese imports of US soybeans were unusually low in July this year, while imports of Brazil soybeans surged considerably.

For some context, China’s purchases of US farm goods up until July are at just ~27% of the target implied by the Phase One trade deal.