Archives of “July 2020” month

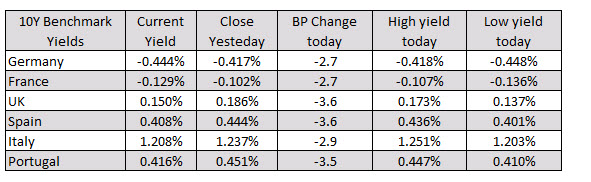

rssECB meet this week (preview) but they are already driving the higher euro

- ECB corporate bond-buying was up 3.3bn EUR last week, which is around 400m higher than the previous record high over the past 4 years operation of the Bank’s corporate bond purchasing program

- financing totalling up to EUR750 bn, split between grants of EUR500 billion and loans of EUR250 billion

- Netherlands, Austria Denmark and Sweden want to reduce the amount of funds distributed as grants

Trump says he is not interested in speaking with China on another trade deal

Whiny biatch speaking in a CBS interview Sry, damn autocorrect. Trump speaking in a CBS interview.

More from Trump:

- We can impose massive tariffs on China f we want

- You’ll see more coming on actions towards China

- China is buying a lot of agricultural products

Strong close for US stocks

Major indices close at session highs

Today saw the stock market rotate into the Dow and broader S&P indices. The tech heavy NASDAQ was the laggard. However a late day surge “raised all boats”. The Dow had its best day since June 29. The dow rose for the 3rd day in a row.

- S&P index rose 42.39 points or 1.34% to 3197.61

- NASDAQ index rose 97.73 points or 0.94% to 10488.53

- Dow industrial average rose 557.72 points or 2.14% at 26643.53

- Caterpillar, +4.96%

- Travelers, +3.8%

- Chevron, +3.49%

- Exxon Mobil, +3.31%

- Home Depot, +3.25%

- McDonald’s, +3.19%

- UnitedHealth, +2.96%

- Goldman Sachs, +2.58%

- Boeing, +2.48%

- First Solar, +9.96%

- Alcoa, +9.47%

- Rite Aid, +7.57%

- Schlumberger, +5.81%

- Ford Motor, +5.12%

- NVIDIA, +3.31%

- Wells Fargo, -4.55%

- Intuit, -4.13%

- Citigroup, -3.93%

- Slack, -3.14%

- LYFT, -3.02%

- Delta Air Lines, -2.61%

- Uber, -2.51%

Thought For A Day

Fear and Greed

Greed and fear are borne from the same parents. They feed on each other. A falling market prompts more selling just as a rising market feeds on itself.

It’s a concept that I just had to learn myself.

Why do stocks that are undervalued continue to be undervalued?

Why do stocks that are overvalued continue to be overvalued?

These momentum types of traits are of the same nature.

Fear prompts more aggressive panic selling ; that’s why stocks that are already slumping continue to be sold and enter a vicious cycle ;

Could be margin calls causing them to fall even further .

This same self reinforcing process operates in the same way on why stock prices can be propelled into the stratosphere. A great story can go on forever whenever the herd mentality is strong. Investors copy each other buying and selling. Greed prompts more euphoria until the loudest and most vociferous voice of the bull market must admit that the honeymoon is over and when it happens; it is a sobering and humbling experience.

When these happen; the most conservative option is to cut costs and hope for the best.

European shares end the session with declines

UK FTSE outperforms

- German DAX, -1.06%

- France’s CAC, -1.25%

- UK’s FTSE 100, -0.10%

- Spain’s Ibex, -1.02%

- Italy’s FTSE MIB, -0.7%

In other markets as European traders look to exit:

- spot gold is trading up $6.05 or 0.34% at $1808.82. The low extended to $1790.79. The high for the day is near current levels at $1809.74

- WTI crude oil futures are trading up $0.31 or 0.77% at $40.41 for the August contract. The September contract is also higher by $0.33 or 0.82% at $40.65

- S&P index up 12.8 points or 0.41% at 3168.16

- NASDAQ index down 2.6 points or -0.02% at 10391.16

- Dow industrial average up 288 points or 1.11% at 26374

The history of globalization.

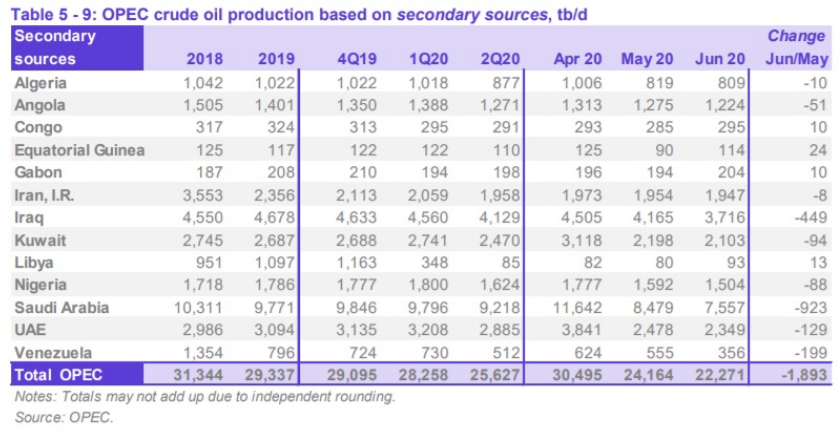

OPEC: Sees demand falling 8.95 mbpd this year, rising by 7 mbpd in 2021

Highlights of the OPEC monthly oil report

- Sees 2020 demand -8.95 mbpd vs -9.07 in prior report

- Sees US output down 1.37 mbpd this year; +0.24 mbpd next year

- Oil stocks are 210 million barrels above 5-year avg

- Efficiency gains and remote working to cap demand rise in 2021 to below 2019 levels

UK government announces ban to Huawei from the country’s 5G networks

Confirmation by UK culture minister, Oliver Dowden

- Telco companies to be barred from buying Huawei equipment from 2021

- UK pledges to remove Huawei equipment by 2027

- Huawei ban will delay, add costs to 5G rollout

- The requirement will be set out in law

Dowden is alluding to the fact that US sanctions have made it hard to come to a decision to continue dealing with Huawei, but this just adds to the divide between the UK and China as well amid the recent Hong Kong row.