Bloomberg report

The US has been pushing a narrative about China stealing user data and hacking with TikTok for awhile. The US government evidently wants to keep a monopoly in that business.

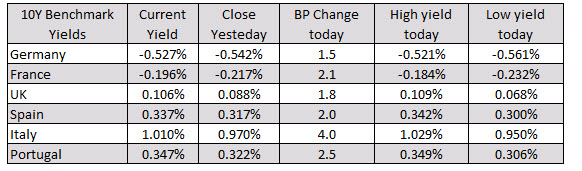

In the benchmark 10 year yields today, yields have moved back higher after being negative at the start of the North American session

The deal will see the firms provide the US government with 100 million doses of the coronavirus vaccine, with the US to provide up to $2.1 billion for development, clinical trials, manufacturing and the delivery of the initial batch of doses.

The Nikkei is ending the week on a softer note, as fears surrounding domestic and global growth are still evident amid the escalating virus situation in Japan and the US. The stronger yen also weighed on exporters as we see USD/JPY fall to 104.00 levels.