- By cutting off that possibility (or imposing a self-restriction on my flexibility), my psychological immune system gets triggered to synthesize happiness.

- My non-conscious processes immediately ‘downgraded’ the idea of trend continuation (if I can’t get on, the trend must be bad), and boosted the idea that the trend will end.

Archives of “July 15, 2020” day

rss“On average, seven S&P 500 stocks (AAPL, AMZN, FB, Goog, MSFT, NFLX, NVDA) are up 45% this year, compared to an average 11% drop for the rest of the index.”

Japan press reports Tokyo to raise COVID-19 alert to the highest level

Asahi with the report (via Bloomberg)

Tokyo has seen renewed outbreaks but up until now had been chilled. according to Asahi that appears ready to change.

ECB meet this week (preview) but they are already driving the higher euro

As was noted during the US time zone, EUR/USD pierced 1.14. A factor that appears to have flown under the radar is this sign of (continued) aggressive policy support from the ECB, that is:

- ECB corporate bond-buying was up 3.3bn EUR last week, which is around 400m higher than the previous record high over the past 4 years operation of the Bank’s corporate bond purchasing program

—

ps, ICYMI, the EU Recovery Fund will be the discussion point of note for markets in the ECB meeting Thursday

- financing totalling up to EUR750 bn, split between grants of EUR500 billion and loans of EUR250 billion

- Netherlands, Austria Denmark and Sweden want to reduce the amount of funds distributed as grants

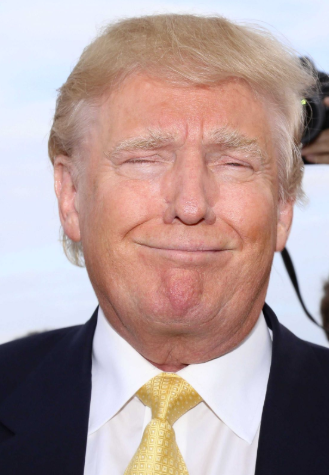

Trump says he is not interested in speaking with China on another trade deal

Whiny biatch speaking in a CBS interview Sry, damn autocorrect. Trump speaking in a CBS interview.

So far he has been whining about getting schools reopened and various grievances he has with life.

Comment on China the only one really pertaining to markets, so far at least.

More from Trump:

- We can impose massive tariffs on China f we want

- You’ll see more coming on actions towards China

- China is buying a lot of agricultural products

Strong close for US stocks

Major indices close at session highs

Today saw the stock market rotate into the Dow and broader S&P indices. The tech heavy NASDAQ was the laggard. However a late day surge “raised all boats”. The Dow had its best day since June 29. The dow rose for the 3rd day in a row.

The final numbers are showing:

- S&P index rose 42.39 points or 1.34% to 3197.61

- NASDAQ index rose 97.73 points or 0.94% to 10488.53

- Dow industrial average rose 557.72 points or 2.14% at 26643.53

Leading the Dow 30 were:

- Caterpillar, +4.96%

- Travelers, +3.8%

- Chevron, +3.49%

- Exxon Mobil, +3.31%

- Home Depot, +3.25%

- McDonald’s, +3.19%

- UnitedHealth, +2.96%

- Goldman Sachs, +2.58%

- Boeing, +2.48%

Other big gainers today included:

- First Solar, +9.96%

- Alcoa, +9.47%

- Rite Aid, +7.57%

- Schlumberger, +5.81%

- Ford Motor, +5.12%

- NVIDIA, +3.31%

Laggards included:

- Wells Fargo, -4.55%

- Intuit, -4.13%

- Citigroup, -3.93%

- Slack, -3.14%

- LYFT, -3.02%

- Delta Air Lines, -2.61%

- Uber, -2.51%

Thought For A Day