The International Monetary Fund (IMF) steeply slashed India’s growth outlook for the current fiscal year to a minus 4.5 per cent from 1.9 expansion estimated in April owing to an extended Covid-19 lockdown and slower economic revival. This will be the lowest in several decades.

In fact, India faced the sharpest cut in the outlook, a 6.4 percentage point revision due a more severe fallout of the pandemic than earlier anticipated. In comparison, emerging markets and developing countries group saw a 2 percentage reduction in outlook while the world outlook was only cut by 1.9 percentage points.

“India’s economy is projected to contract by 4.5 per cent following a longer period of lockdown and slower recovery than anticipated in April,” the IMF said in its latest World Economic Outlook, titled ‘A Crises like No Other, An Uncertain Outlook’. India’s growth is expected to revive to 6 per cent in 2021-22, as per IMF.

With downturn deeper than previously projected, the global output will shrink by 4.9 per cent and emerging markets by 3 per cent this year.

“For the first time, all regions are projected to experience negative growth in 2020,” said the IMF.

Incidentally, China is estimated to post a 1 per cent growth in 2020, and revive to 8.2 per cent in 2021. (more…)

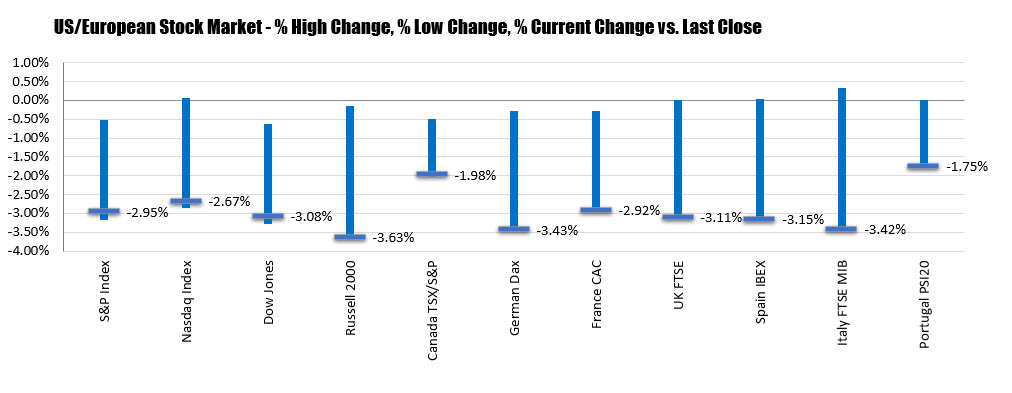

The US shares are also currently trading at session lows with the Dow industrial average leading the way to the downside with a -3.08% decline.

The US shares are also currently trading at session lows with the Dow industrial average leading the way to the downside with a -3.08% decline.