Sharp drop in North American trade

The Australia dollar completed the coronavirus comeback yesterday as it completely recouped the March-April decline to trade back to where it was in mid-February.

What next?

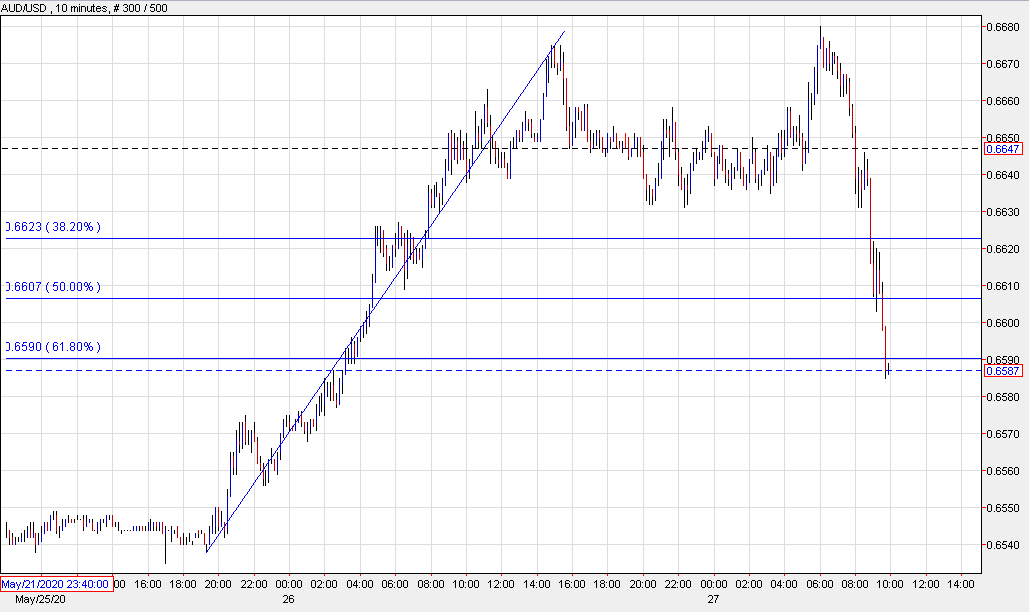

Today the mood is AUD/USD isn’t so rosy, the pair has fallen 80 pips in the past couple hours after making a margin new high but failing to extend. Part of that is broad US dollar strength but the weakness is accelerating and that’s a negative signal for the risk trade.

There’s still some rope left in yesterday’s rally but we have crossed the 61.8% retracement of that move.