Silver to Play Critical Role in 5G Technologies

The SMCCF is expected to begin purchasing eligible ETFs in early May. The PMCCF is expected to become operational and the SMCCF is expected to begin purchasing eligible corporate bonds soon thereafter. Additional details on timing will be made available as those dates approach.

The PMCCF will provide a funding backstop for corporate debt to Eligible Issuers so that they are better able to maintain business operations and capacity during the period of dislocation related to COVID-19. The SMCCF will support market liquidity for corporate debt by purchasing individual corporate bonds of Eligible Issuers and exchange-traded funds (ETFs) in the secondary market.

The PMCCF will provide companies access to credit by (i) purchasing qualifying bonds as the sole investor in a bond issuance, or (ii) purchasing portions of syndicated loans or bonds at issuance. The SMCCF may purchase in the secondary market (i) corporate bonds issued by investment-grade U.S. companies; (ii) corporate bonds issued by companies that were investment-grade rated as of March 22, 2020, and that remain rated at least BB-/Ba3 at the time of purchase; (iii) U.S.-listed ETFs whose investment objective is to provide broad exposure to the market for U.S. investment-grade corporate bonds; and (iv) U.S.-listed ETFs whose primary investment objective is exposure to U.S. high-yield corporate bonds.

I have some questions regarding eurodollars and attempted to answer them myself: Why is GE quoted as interest rates, but de facto acts like a commodity ? Why were GE quotes up (rates on eurodollar deposits down) during the 2008/2020 crises. There was lots of cash demand.

– GE futures prices DO show de facto demand for cash (any fx cash offshore demand)

– GE is priced as rate to par of deposits

– GE reacts to or anticipates FED rates, as FED reacts to cash demand

– the rate of the deposits are not directly driven by supply and demand of global cash, but are driven by “external”/ non-eurodollar-mkt interest rates

– GE quotes can not be understand by the internal supply and demand of the eurodollar mkt conclusion: even GE-quotes are interest rates, GE-quotes act de facto like commodity prices, e.g. currently show huge cash demand.

Does you agree with my answers?

Gilead arguably has the best science in the business. But success in Biotech / Pharma is reserved for those who keep their customers alive, but milk them forever by not curing them of anything.

Hits against Gilead:

1. Gilead did not make any friends by creating the Gardasil vaccine for HPV, which killed the downstream pipeline for those companies that would have treated HPV for 40-50 years.

2. Gilead does not have deep hooks inside the FDA either

Regeneron on the other hand has deep contacts inside the FDA and also practices the milking-forever business model. If they package dried-prunes as a cure for Covid, FDA will merrily approve it.

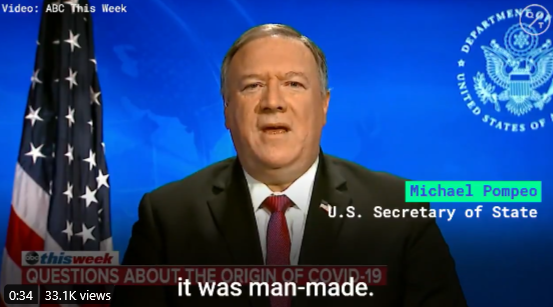

RADDATZ: Do you believe it was manmade or genetically modified?

POMPEO: Look, the best experts so far seem to think it was manmade. I have no reason to disbelieve that at this point.

RADDATZ: Your — your Office of the DNI says the consensus, the scientific consensus was not manmade or genetically modified.

POMPEO: That’s right. I — I — I agree with that. Yes. I’ve — I’ve seen their analysis. I’ve seen the summary that you saw that was released publicly. I have no reason to doubt that that is accurate at this point.

RADDATZ: OK, so just to be clear, you do not think it was manmade or genetically modified?

POMPEO: I’ve seen what the intelligence community has said. I have no reason to believe that they’ve got it wrong.

“Personally I think [China] made a horrible mistake. They tried to cover it up. It’s really like [they were] trying to put out a fire. They couldn’t put out the fire,” Trump said.

“We’re going to have to see what’s going on [with the purchases] because of what happened,” said Trump. “They took advantage of our country. Now they have to buy and, if they don’t buy, we will terminate the deal. Very simple.”

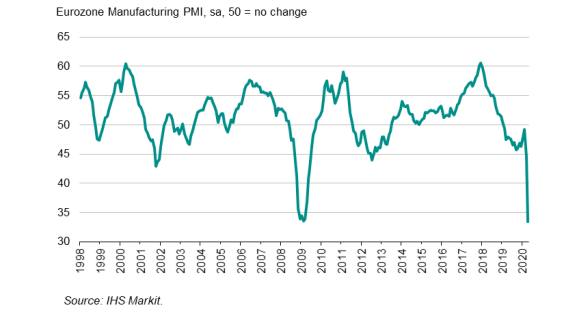

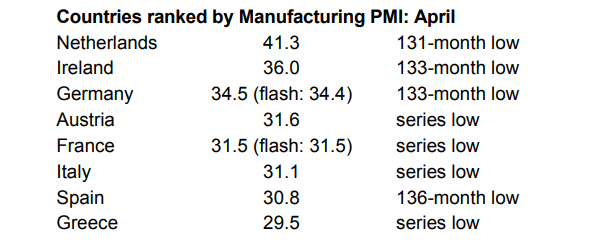

The preliminary release can be found here. Not much change to the initial estimate as euro area manufacturing activity experiences an unprecedented decline amid lockdown measures in the region to contain the virus outbreak. A summary:

“Euro area manufacturing output plunged to an extent greatly exceeding any decline previously seen in the near 23-year history of the PMI survey in April, reflecting a combination of factors including widespread factory closures, slumping demand and supply shortages, all linked to the COVID-19 outbreak.

“All countries suffered record falls in factory output, with Italy reporting the sharpest decline, as measures to contain the coronavirus intensified during the month.

“With virus curves flattening and talk now moving to lifting some of the pandemic restrictions, April will have hopefully represented the eye of the storm in terms of the virus impact on the economy, meaning the rate of decline will now likely start to moderate. Barring any second wave of infections, which would throw any recovery off course, the news should start to improve as we see more people and businesses get back to work.

“However, the PMI is indicating an industrial sector that has collapsed at a quarterly rate of decline measured in double digits, and any recovery will be frustratingly slow. Steps needed to keep workers safe will mean even businesses that are able to restart production will generally be running at low capacity, and most will be operating in an environment of greatly reduced demand. Not only will household spending remain historically weak, not least due to ongoing shop closures, but business spending on inputs and machinery and equipment will also remain subdued for some time.”