German DAX surges by 5.6%

the major European indices have gotten a big boost to the upside with help late in the day by the German Franco proposed reconstruction plan.

The numbers are showing:

- German DAX, +5.67%

- France’s CAC, +5.25%

- UK’s FTSE, +4.3%

- Spain’s Ibex, +4.5%

- Italy’s FTSE MIB +3.32%

- Portugal’s PSI 20+4.4%

All indices are closing near highs for the day.

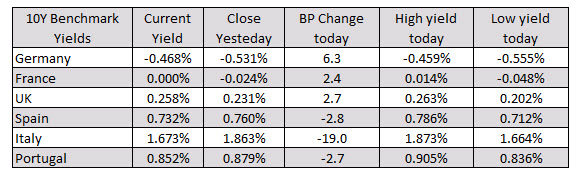

In the European debt market, yields were mixed as investors shun the safer countries i.e. Germany, France, UK, and poured money into the riskier (risk on) countries led by Italy with a -19 basis point decline.

In other markets as London/European traders look to exit:

- spot gold has reversed sharply lower and currently trades down $9.10 or -0.52% at $1734.50

- WTI crude oil futures are rising sharply with the July contract up $3 or 10.09 percent at $32.44

In the forex, the US dollar has moved sharply lower in the New York morning session. The JPY remains the weakest of the majors as JPY pairs soar on risk on sentiment. The NZD and the AUD continues their run to the upside, and are the strongest of the majors. The NZDJPY is up near 2% on the day and is the biggest mover the day.