- A losing trader can do little to transform himself into a winning trader. A losing trader is not going to want to

transform himself. That’s the kind of thing winning traders do. - The winning traders have usually been winning at whatever field they are in for years.

- It is a happy circumstance that when nature gives us true burning desires, she also gives us the means to

satisfy them. Those who want to win and lack skill can get someone with skill to help them. - The “doing” part of trading is simple. You just pick up the phone and place orders. The “being” part is a bit more subtle. It’s like being an athlete. It’s commitment arid mission. To the committed, a world of support appears. All manner of unforeseen assistance materializes to support and propel the committed to meet grand destiny.

- In your recipe for success, don’t forget commitment – and a deep belief in the inevitability of your success.

Archives of “May 22, 2020” day

rssBaker Hughes US weekly oil rig count 237 vs 244 prior

Baker Hughes weekly rig count

- Prior was 244

- Natural gas rigs 79 vs 79 prior

Drilling rigs continue to fall. WTI is down 98-cents to $32.94 today but prices are still up dramatically in a month. The speed with which supply has matched the drop in demand is unbelievable to me.

Do Not Shut Out or Ignore Your Fear

- The positive intention of fear is risk control.

- People who are unwilling to experience fear tend to take big risks and wind up in big drama in which the risk materializes.

- People with poor risk control tend to bet heavy. So they tend to outperform others in good markets, and under-perform them in poor ones.

- Risk is the uncertain possibility of loss. If you could quantify risk exactly, it would no longer be risk.

- Risk control has to do with your willingness to allow your stop to do its job.

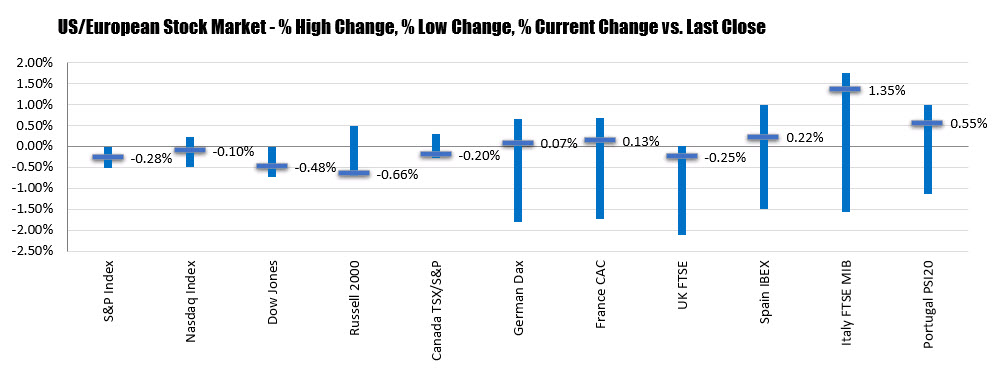

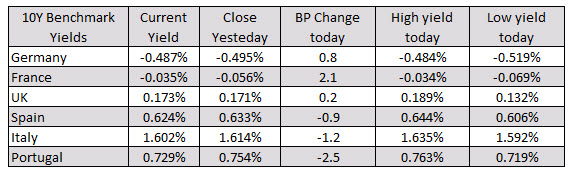

Major European indices are ending the day little changed.

Italy’s FTSE MIB bucks the trend with a 1.2% gain

The major European indices are ending the week with mostly modest gains/losses for Friday. The indices are also well off of their intraday lows. The provisional closes are showing:

- German DAX, up 0.1%. At the low the index was down -1.8%

- France’s CAC, up 0.1%. At the low the index was down -1.72%

- UK’s FTSE 100, -0.3%. At the low the index is down -2.11%

- Spain’s Ibex, unchanged. At the low the index is down -1.5%

- Italy’s FTSE MIB, +1.2%. At the low the index was down -1.56%

In the European debt market, the benchmark 10 year yields are ending the session with mixed results. Germany, France, UK yields lower marginally higher with the France yields up 2.1 basis points. Spain, Italy, Portugal yields are lower with Portugal down -2.5 basis points

For the week, the major indices closed sharply higher with the German DAX leading the way with a 5.8% gain:

- German DAX, 5.8%

- France’s CAC, +3.8%

- UK’s FTSE 100, +3.3%

- Spain’s Ibex, +3.3%

- Italy’s FTSE MIB, +2.6%

Hold Your Position Until the Trend is Invalidated, Do Not Let Go of Your Position. Be Willing to Experience Your Anxieties

- Maintaining a commitment is particularly important when it comes up for a test.

- Somewhere along the line of keeping your commitment you may get a feeling that you don’t like.

- If you are willing to experience the feeling, it can transform into an AHA that supports your commitment.

- If you are unwilling to experience the feeling, you might abandon your commitment to try to make the feeling go away. That only results in having to feel the feeling after all.

- The more you are willing to experience the feeling of bumping into walls, the less you have to bump into walls.

- Trading requires skill at reading the markets and at managing your own anxieties.

- People have a Conscious Mind and Fred. Fred wants to communicate feelings to CM so CM can experience them and gain experience and share it with Fred so Fred can learn how to react. This is how we manufacture wisdom. When we don’t like our feelings we tie them in k-nots and do not experience them. This interrupts the wisdom manufacture process, and draws drama into our lives.

- K-nots, protect us from truth and keep our lives in drama. To untie k-nots, fully experience whatever appears in the moment.

- When you keep your eye on the prize and are willing to experience all the feelings that arise, the prize soon becomes yours.

White House’s Hassett: Studying very closely economic penalties for China

Comments from White House economic advisor Kevin Hassett

- Says all options on the table for China

Hassett is an odd guy to be commenting on this. He’s the economic guy but he’s not the guy who is usually talking about sanctions or things along those lines.

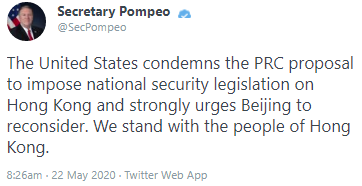

I keep going back to this comment from the Secretary of State and it’s soft.

I mean, “strongly urge”?

I just don’t see the US taking a real stand here. I mean, Russian annexed Crimea and what did they do? Some weak sanctions?

That said, who knows? The US reaction is the spot to watch right now and if they deliver something truly meaningful than it could be a game-changer. All eyes on Trump.

China bets the US won’t do anything about Hong Kong takeover (and so do markets)

China has ended Hong Kong’s autonomy and signaled aggression in Taiwan

On pure politics alone, you have to give China credit: They opportunistically used a global pandemic to end Hong Kong’s autonomy.

The execution so far has been perfect. Six months ago they appeared to be on the edge of sending in the mainland police in a move that would have triggered massive protests and enormous international pressure. Instead, the pandemic fell into their lap and they put out a garbled ‘proposal’ with vague reassurances. Effectively, they can now can supersede Hong Kong’s legislature.

Make no mistake, this is the end of Hong Kong. Mainland police will be on the ground.

Naturally, they masked it in with the classic justifications about security and foreign interference. So far it’s worked. I hope I’m wrong, but I don’t see it capturing the world’s imagination and not much of the market cares right now.

The story now is the limp US political response. Sanctioning a few individuals and banks? Do they think that’s going to discourage Beijing?

Here’s Senator Josh Hawley who is grandstanding on a harshly worded letter:

That’s laughable.

China has read the situation correctly: The US isn’t going to do anything meaningful. Even uberhawk Pompeo basically folded:

Yesterday Trump appeared to have no idea what was happening, saying “nobody knows yet” the details of China’s plan. “If it happens we’ll address that issue very strongly,” he said.

We’ll see and that’s the big risk for markets in the days ahead. Further out, China made a chilling change in the usual statement about Taiwan.

“We will encourage them to join us in opposing Taiwan independence and promoting China’speacefulreunification,” Li said. “With these efforts, we can surely create a beautiful future for the rejuvenation of the Chinese nation.”

Traditionally, the word ‘peace’ precedes ‘reunification’ in this statement.

This is well-and-truly the beginning of an expansionist China and its march towards regional dominance.

In terms of markets, appeasement from the US is actually a positive for markets in the short-term — at least outside of Hong Kong. That could change if the US decides to draw a line in the sand.

View Full Article with Comments

George Soros: Coronavirus damage to Eurozone economy will last longer than most people think

Some remarks on the euro area by Soros

- The survival of the EU is being challenged

- This is not a theoretical possibility; it may be a tragic reality

- EU needs to consider perpetual bonds, otherwise it may not survive

- Says that he is particularly concerned about Italy

- Says that Italy has been treated badly by the EU and Germany

Soros has been floating the idea of perpetual bonds since the beginning of the crisis but his idea does have its own validity since

China state media report on China taking ‘forceful measures’ on Hong Kong

Xinhua on measures submitted to China’s national legislature for deliberation on Friday.

- draft on establishing and improving the legal system and enforcement mechanisms for Hong Kong

- the increasingly notable national security risks in HK have become a prominent problem, the document says

- activities have … harmed the rule of law, and threatened national sovereignty, security and development interests

- Law-based and forceful measures must be taken to prevent, stop and punish such activities, according to the document.

China did not send in troops at the height of the protests in 2019. Will they do so this year? Pretty strong words from the draft.

China economy targets for 2020

Instead:

- seeks to add 9m urban jobs this year

- jobless rate target around 6%

- inflation aim is around 3.5% (last year’s was 3%)

- target for their budget deficit is above 3.6% of GDP (last year’s was 2.8%)

- will sell CNY 1tln of anti-virus bonds this year

More:

- to keep yuan basically stable

- to amend monetary policy tools to better serve the economy

- to use innopvative mon pol tools to finance the real economy

- to guide money supply significantly higher than last year