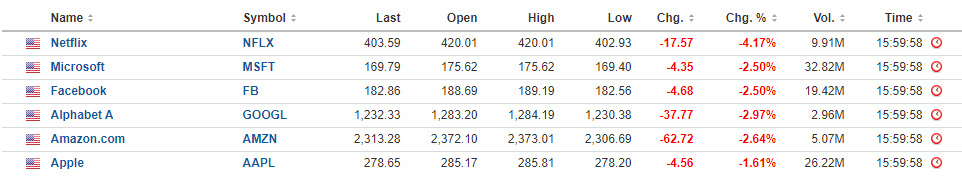

Nasdaq under pressure ahead of the Big 5 earnings

As mentioned in prior posts today, Alphabet, Amazon, Facebook, Microsoft and Facebook will all report earnings this week. In advance of those risk events, market traders took profits selling each lower on the day. If you were to add Netflix to the mix (they reported last week), all 6 of those influential stocks fell more than the overall market (Nasdaq was down -1.40% on the day).

The final numbers for the major indices are showing:

- S&P index fell -15.09 points or -0.52% to 2863.39

- NASDAQ index fell -122.43 points or -1.4% to 8607.73

- Dow fell -32.23 points or -0.13% to 24101.55. Dow fell for the 1st time after rising the last 4 days in a row.