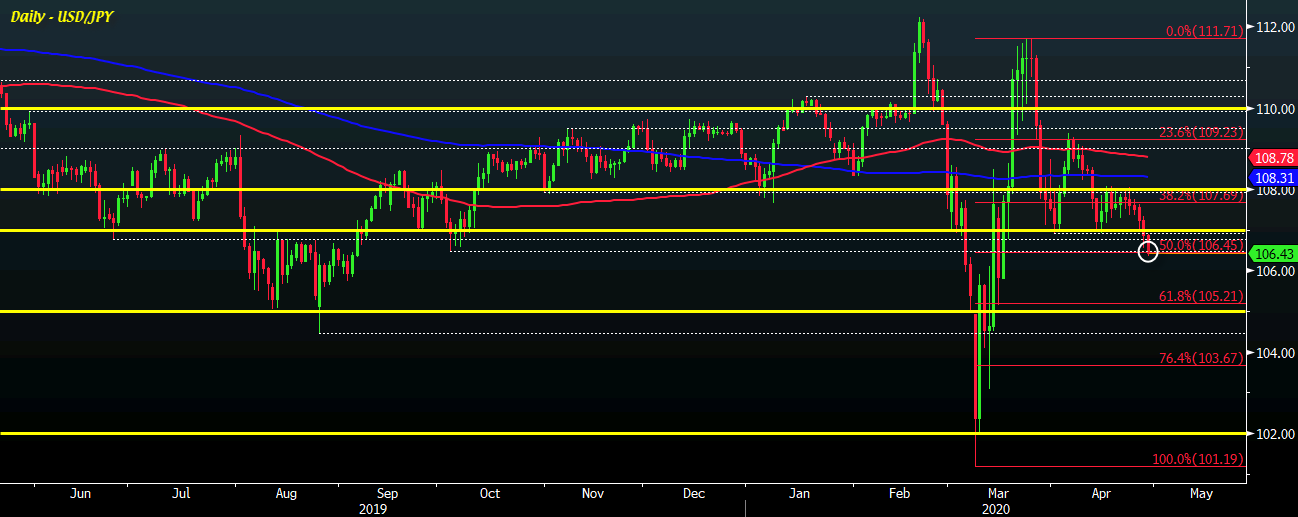

USD/JPY runs into the 50.0 retracement level of the recent swing move higher back in March

That level sits at 106.45 and will be a key daily support to watch before a potential drop back towards 105.00 next in the pair. The shove lower comes as the dollar is continuing to stay weaker across the board in European morning trade.

Despite some recovery in the dollar late yesterday, the fact that USD/JPY failed to reclaim 107.00 continues to give sellers the advantage from a technical perspective.

And so far, sellers are continuing to keep up the momentum in trading today.

The mood in equities is still more or less the same with European stocks holding mild gains with US futures up by around 0.7% currently. Meanwhile, the bond market is telling a different story with US 10-year yields down by about 2 bps to 0.593%.

For now, the daily support at 106.45 will be key for USD/JPY sentiment. A firm run below that will see little in the way of stopping a move back towards 105.00 potentially.

The risk for sellers is if buyers start to chase a move back above 107.00.

Looking ahead, the Fed will be the key risk event to watch today so let’s see if there will be more market clarity once that is over and done with.