Against All Odds

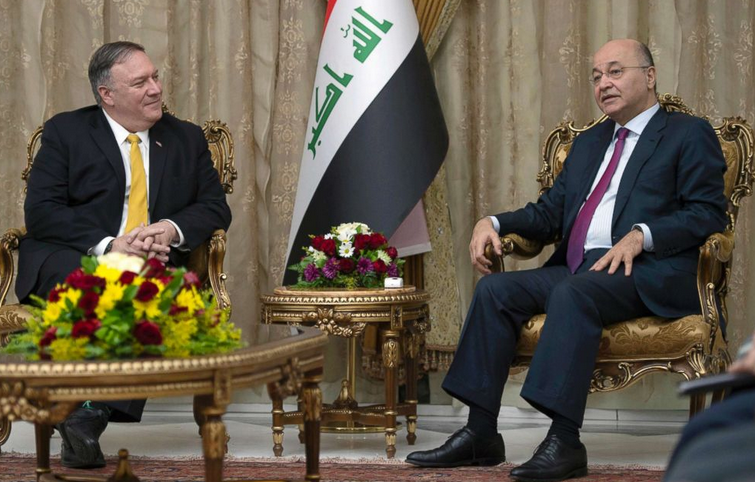

An adviser to the prime minister, Abd al-Hassanein al-Hanein, said that while the threat of sanctions was a concern, he did not expect the U.S. to go through with it. “If the U.S. does that, it will lose Iraq forever,” he said.

Market patterns don’t reverse in 10-year cycles like clockwork; there’s no guarantee that the coming decade will be the opposite of the one that just ended. But before you bet that the future will be like the past, it’s worth remembering that this decade hasn’t turned out the way investors predicted it would 10 years ago.

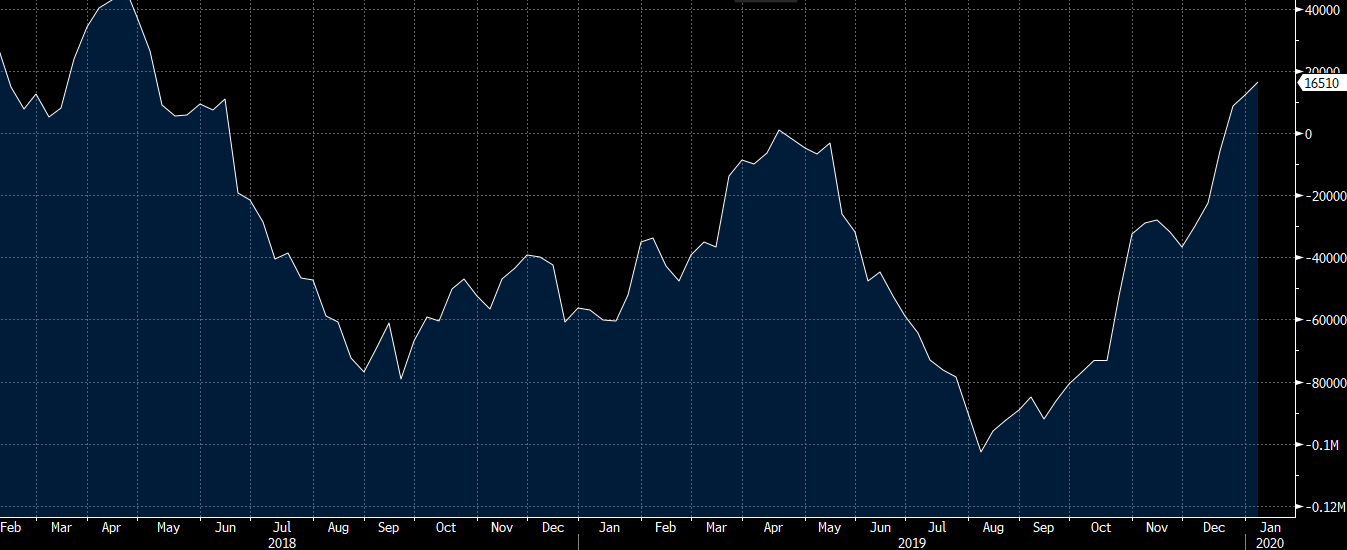

The theme across the board was less enthusiasm for the dollar. All the dollar longs were trimmed and there are growing longs in CAD and GBP. Is this really the big turn in the dollar? There is certainly some room to run on the speculative side before we get even close.

On the week:

The turnaround today is a bit of warning signal. Note that January is a weak seasonal month but there is a long-term trend of strength early in the month. I also tend to think the signing of the ‘phase one’ deal is sell-the-fact risk.