It will spread to nearby cities and countries next

A UK expert on the transmission and evolutionary dynamics of infectious diseases has published a

paper with four colleagues that estimates transmission parameters for the Wuhan coronavirus and it’s terrifying.

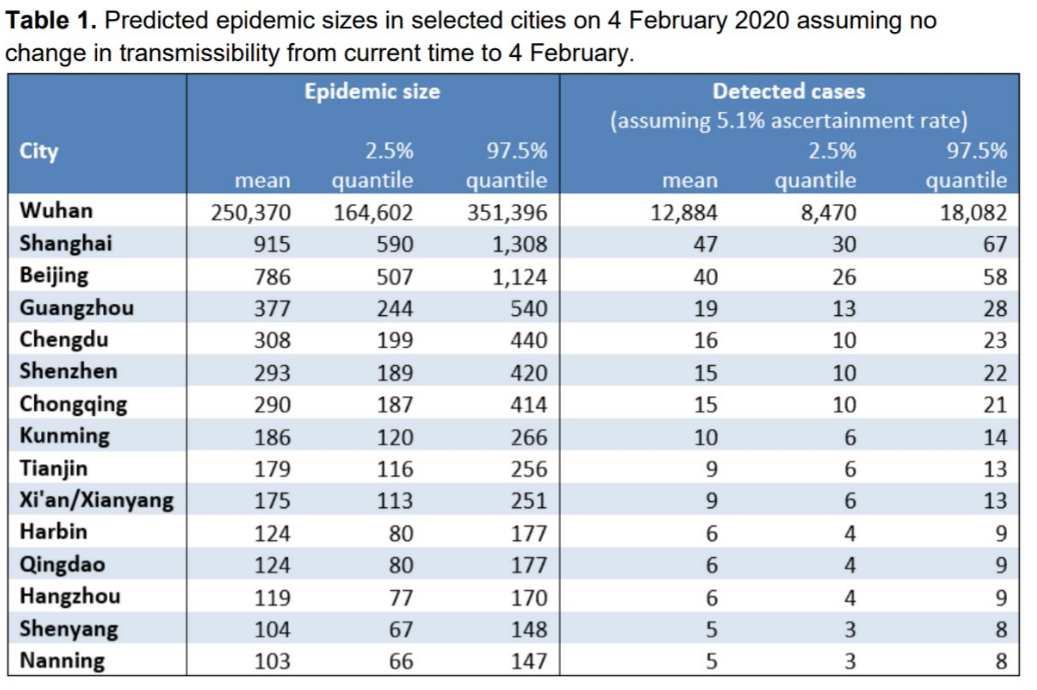

Dr Jonathan Read estimates that only 5.1% of infections in Wuhan are identified and that an explosion in the number of cases is less than two weeks away.

By February 4, he writes that “our model predicts the number of infected people in Wuhan to be greater than 250,000 (prediction interval, 164,602 to 351,396).”

Based on travel patterns, his team predicts the cities with the largest outbreaks elsewhere in China to be Shanghai, Beijing, Guangzhou, Chongqing and Chengdu. The countries with the greatest risk of importing it are Thailand, Japan, Taiwan, Hong Kong, and South Korea.

(more…)