German DAX rises by 1.11%. UK FTSE up 0.87%

- German DAX, +1.11%

- France’s CAC, +1.14%

- UK’s FTSE, +0.87%

- Spain’s Ibex, +1.4%

- Italy’s FTSE MIB, up 1.4%

- Portugal PSI 20, up 1.0%

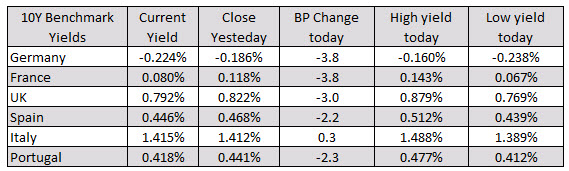

In the debt market, the benchmark 10 year yields so yields move lower. The German and French 10 year oat fell -3.8 basis points on the day. Italy’s 10 year note rose by 0.3 basis points.

- Spot gold is up $10.77 or 0.71% at $1528.06. The price is off its high at $1531.40

- WTI crude oil futures are now trading lower by $0.27 or -0.44% at $60.78. That is near the low price for the day at $60.70. The high price extended to $61.60