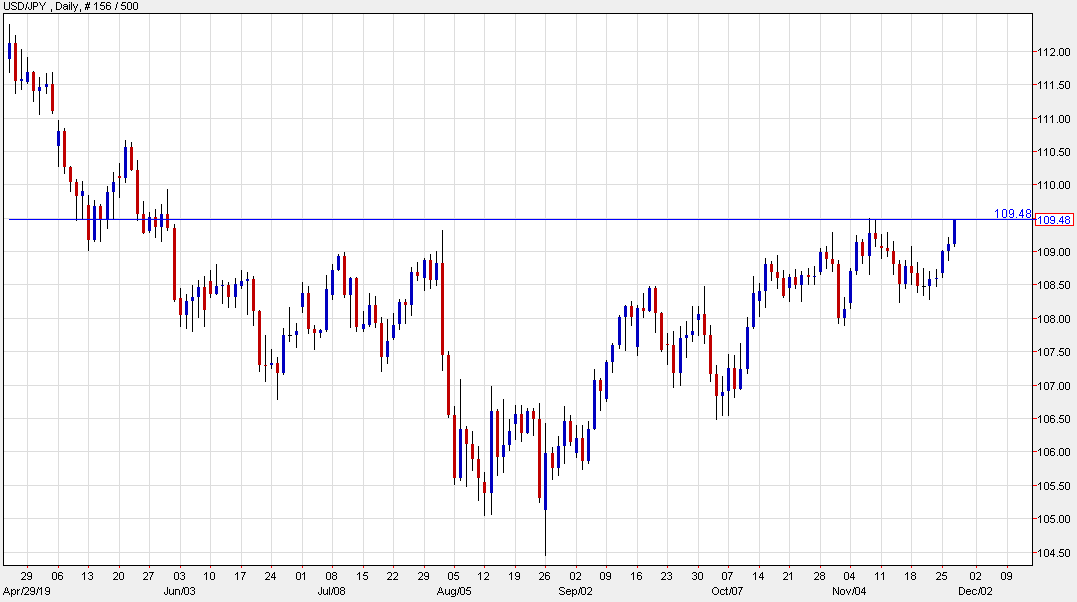

The dollar is keeping a little more firm in the European morning so far

And that is helping to see EUR/USD linger near the 1.1000 handle with the low today reaching 1.1003. Sellers remain in near-term control of the pair but trading may be a bit more tepid for now as we look towards a barrage of data to come from the US later.

That will be the key risk event for the dollar and also for EUR/USD in trading today.

But let’s take a look at what are the key levels that buyers and sellers may look to lean on should we see price action move around later on.

The 1.1000 level in itself is already a key one to watch but add in large expiries rolling off today around 1.0995-00, it only makes the figure level more of a magnet for now.

Below that, the 14 November low @ 1.0989 will be a notable one to watch as well. A fall below that will accelerate momentum to the downside for sellers.

Meanwhile, for buyers, any move higher needs to work towards breaking the 100-hour MA (red line) @ 1.1032 first before challenging the 200-hour MA (blue line) @ 1.1049.

A break above those two levels will see buyers reclaim near-term control before potentially moving towards a test of the 100-day moving average @ 1.1080 with further swing region resistance seen around 1.1090-00 next.

Those will be the key technical levels to watch out for now but how price action will play around these levels will depend on how the slate of data from the US plays out later today.