Spain’s Ibex down marginally. German Dax up 0.2%

The major European shares are closing the day mostly higher with the Spanish Ibex the exception. The provisional closes are showing:

- German DAX, +0.2%

- France’s CAC, +0.2%

- UK’s FTSE, unchanged

- Spain’s Ibex, -0.4%

- Italy’s FTSE MIB, unchanged

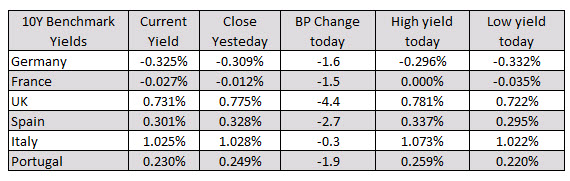

In the European debt market, the benchmark 10 year yields are ending the session lower:

In other markets, a snapshot is showing:

- spot gold is up $5.10 or 0.35% at $1488.62

- WTI crude oil futures are down $0.44 or -0.75% at $56.79

in the US stock market the major indices are currently trading mixed:

- S&P index is up 1.2 points or 0.04% at 3075.80

- NASDAQ index is still down -22.6 points or -0.27% at 8412.10

- Dow is up 12.50 points or or 0.05% of 27505

In the forex market, the major indices remain bunched together with the JPY and NZD the strongest and the CAD the weakest. The USD is a little higher overall with the largest gain vs the CAD and largest decline vs the JPY.