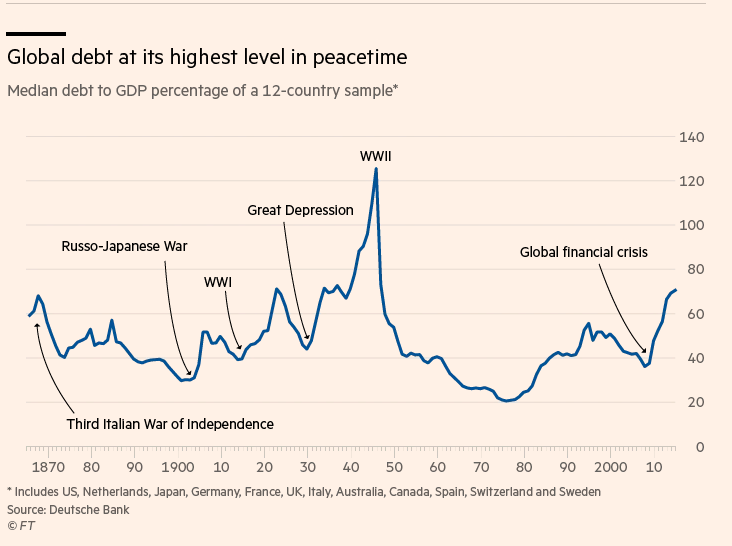

Global debt is currently at it’s highest level in peacetime,

On average, the world’s major economies, have debts of more than 70% of their GDP’s. This is the highest level in the past 150 years apart from s spike during WWII. See the chart below courtesy of the Financial Times

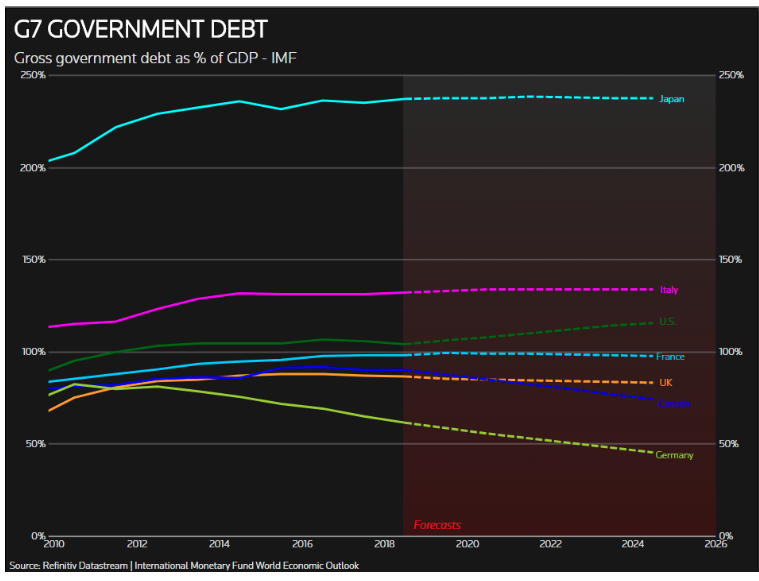

In the UK that debt deficit is presently at around 87%, but it is only set to grow with both Conservative and Labour plans to increase public spending levels. This will in part be a Brexit boost to lift morale. Increasing welfare states, growing democracies and an ageing population all lead to to the conclusion that global debt is set to keep growing.