The Dow above 28000 for the first time ever. Indices close at record all time high levels.

The major indices are closing at records. The Dow hits 28,000 for the 1st time ever and looks like my close above that level as well. The S&P index and NASDAQ index are also trading at record levels and closed at the highs. It is hard to get any better than that.

The closing numbers are showing:

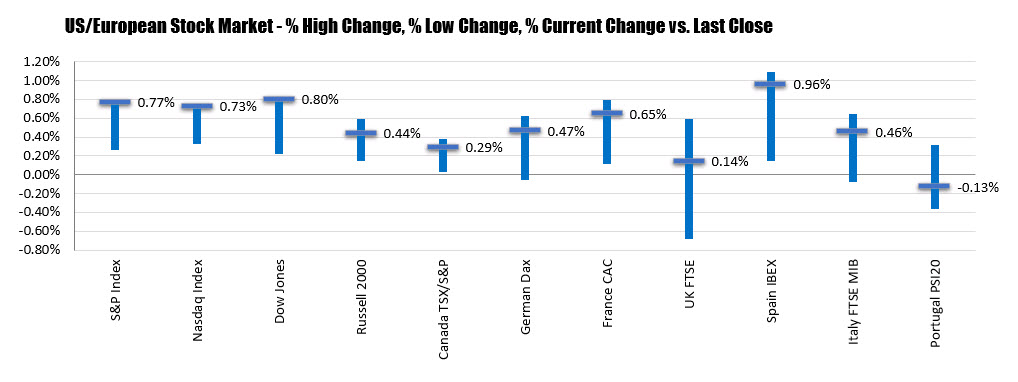

- The S&P index up 23.73 points or 0.77% at 3120.37. That is the high for the day. The low for the day was down at 3104.60

- The NASDAQ index is up 61.81 points or 0.73% at 8540.82. That too is the high for the day. The low for the day reached 8506.79.

- The Dow close up 222.45 points or 0.80% at 28004.69. Yes. it too is at the high for the day. The low for the day reached 27843.54.

Below are the percentage changes of the major North American and European indices today (along with their low to high ranges).

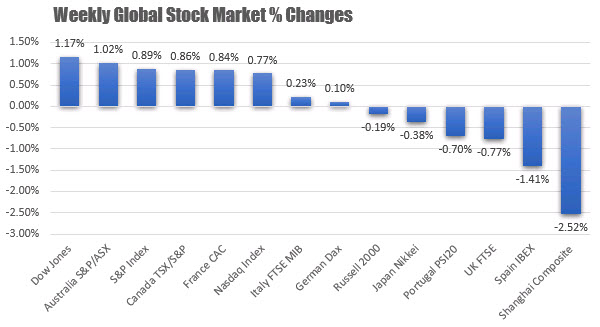

For the week, the Dow was the biggest gainer of a sample of major indices. The Shanghai composite index was the biggest decliner at -2.52%.